In the old days, when a stock or a market index broke out of a trading range accompanied by some "oomph," it was good thing. In fact, such an event was considered to be a strong signal that the move would continue and that it was time to jump on board the bull train. "Buy high, sell higher" was the momentum trader's battle cry.

However, times were simpler then. The "fast money" types weren't on television all day, every day, teaching anyone willing to listen how to "fade" every rally. Computers didn't run the game. Volume was "real" and trades weren't measured in nanoseconds. No, when a significant breakout occurred on the charts, it meant that folks were buying in a big way. Thus, it generally paid to follow the crowd.

In my paper entitled, The Tactical Dilemma I detail how and why such an approach has become less effective in recent years. I provide examples of traditional trend- and momentum-oriented indicators that after working well for literally decades, have stopped working altogether since the credit crisis ended.

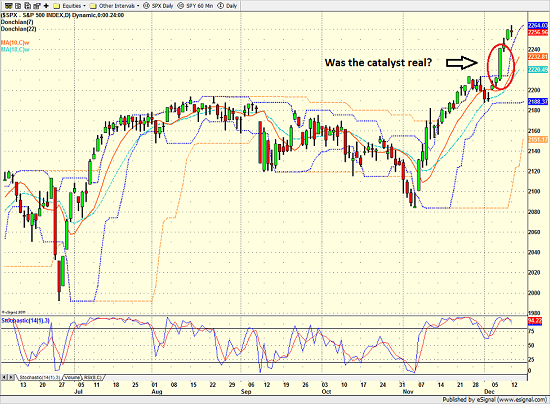

Why do I bring this up on this fine Tuesday morning? In short, because it appears that we are witnessing a classic momentum breakout. A move that began last Wednesday and was accompanied by very strong volume. And a move that is now experiencing what is called "follow through."

For those that haven't been around the game for a couple decades, this combination used to be a very good sign. However, today the question that has to be asked is: Was the move real or just another example of high-speed trading gone haywire?

S&P 500 - Daily

View Larger Image

I know that most everyone agrees that the "Trump Trade" is the driving force right now in the markets. And given the state of the calendar, it isn't surprising to see investors of all shapes and sizes clamoring to get on the bull train. After all, everybody knows that the best time of year to be in stocks is between November and April. And with expectations running high that the Trump administration will create a strong macro backdrop for stocks, it makes sense that now is the time to be buying - perhaps even with both hands, right?

However, before we break into the next chorus of "Happy Days Are Here Again," consider the possibility that the recent catalyst may have been less about the bulls making a break for the border and more about some trader placing a big trade.

According to the Wall Street Journal, last week's "breakout" was triggered by a single trade. A trade that was indeed a whopper. The Journal's Alexander Osipovich writes, "A $1.8 billion futures trade that fueled buying in the U.S. stock market on Wednesday was the biggest transaction of its kind all year... and comparable in size to the 'fat finger' trade said to have set off the May 2010 flash crash."

In case you aren't familiar with the interworking's of the stock market these days, understand that "ignition algos" are a thing. The idea behind this kind of trade is that somebody, somewhere puts a big trade on, very quickly. The thinking is this will be a signal to all high-speed, trend-following algos that a new trend has begun. And if all the folks playing this game see the same thing, at the same time, well, you get the picture.

As a former old-school trend and momentum guy, my training says, hey, that was clearly a critical breakout on the charts and that the bulls are now in charge. And given that a new bull market began back in February and could have a long way to go, the plan going forward should be to buy the dips - any dips!

Unless, of course, the premise here is false. Unless, of course, the $1.8 billion trade last Wednesday was either a mistake or simply an "ignition trade" intended to make a few quick bucks. And unless, of course, the market suddenly pulls back and the anticipated "retest" of the breakout zone (around 2215 on the S&P 500 cash index) turns into a "failure."

So... While I DO believe that we are seeing a meaningful move in stocks and I DO believe that the bulls are likely to remain in charge, we must recognize that this move has been straight up and that the current rate of ascent is unsustainable. Therefore, some sort of pullback and then a "retest" of the breakout would be logical. And assuming that the bulls prevail during this process, I would then consider an old fashioned momentum move to be in play. Until then, color me a bit skeptical and yet, cautiously optimistic (old habits are hard to break!).

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can both identify and understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the "Trump Trade"

2. The State of Global Central Bank Policies

3. The State of Global Economies

Thought For The Day:

Without the dark, we'd never see the stars --Unknown

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Looking for a "Modern" approach to Asset Allocation and Portfolio Design?

Looking for More on the State of the Markets?

Investment Pros: Looking to modernize your asset allocations, add risk management to client portfolios, or outsource portfolio design? Contact Eric@SowellManagement.com

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member