Overview

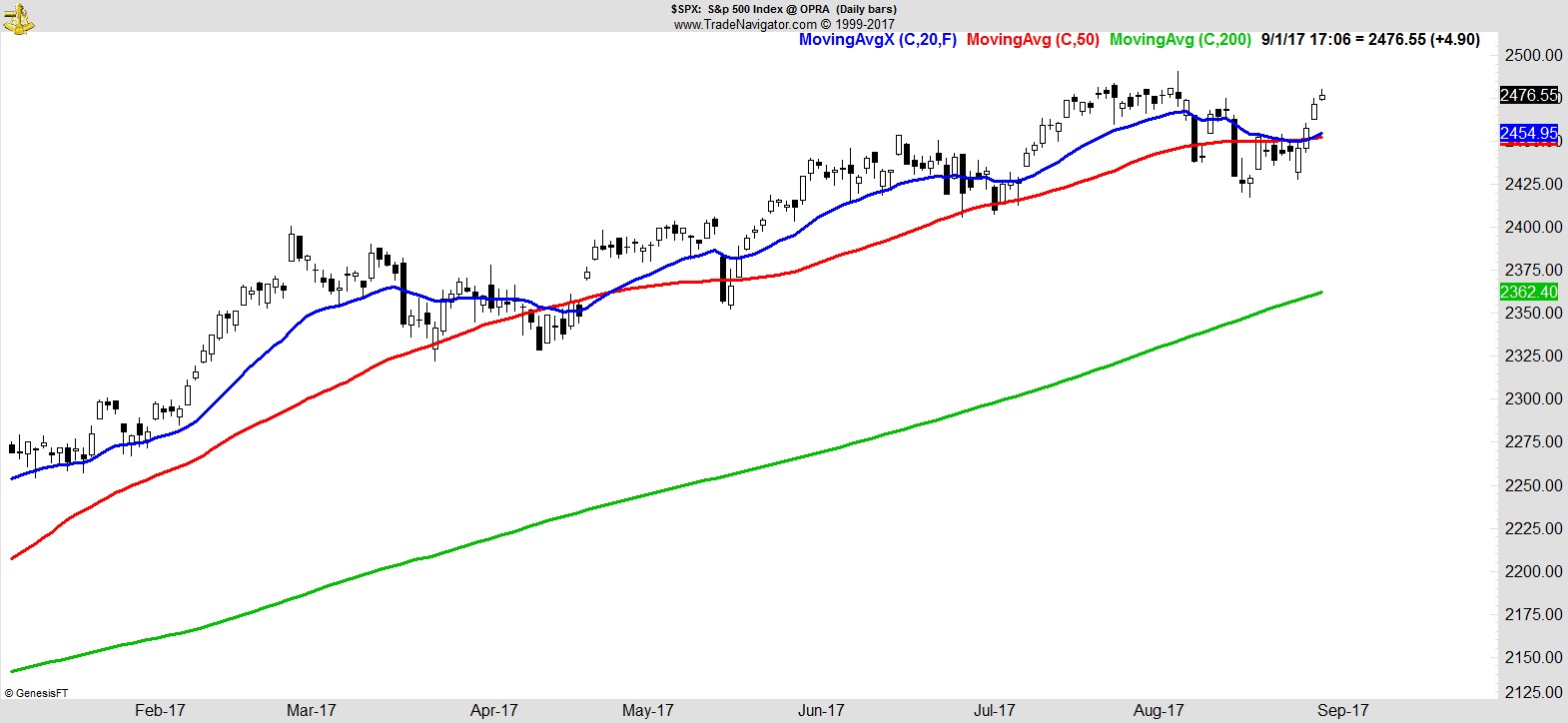

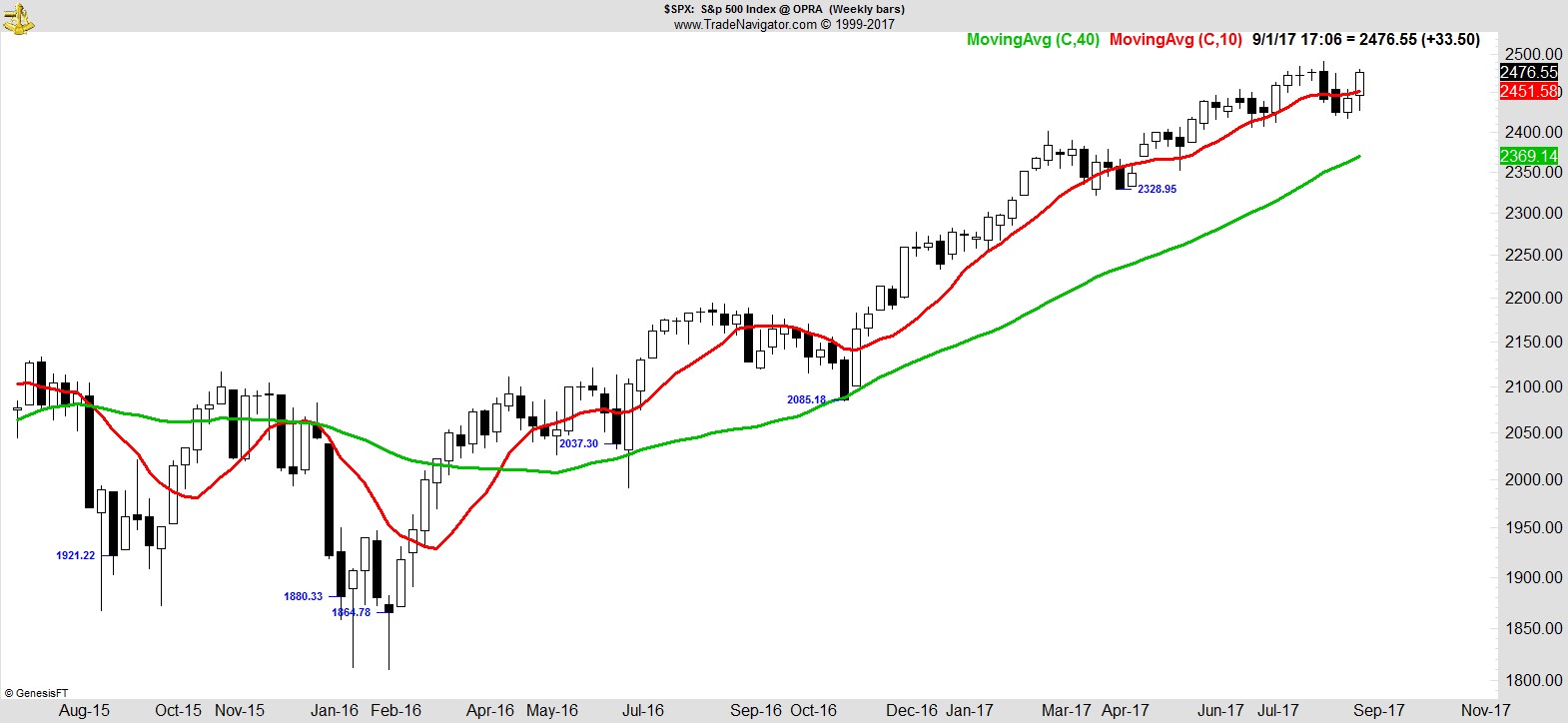

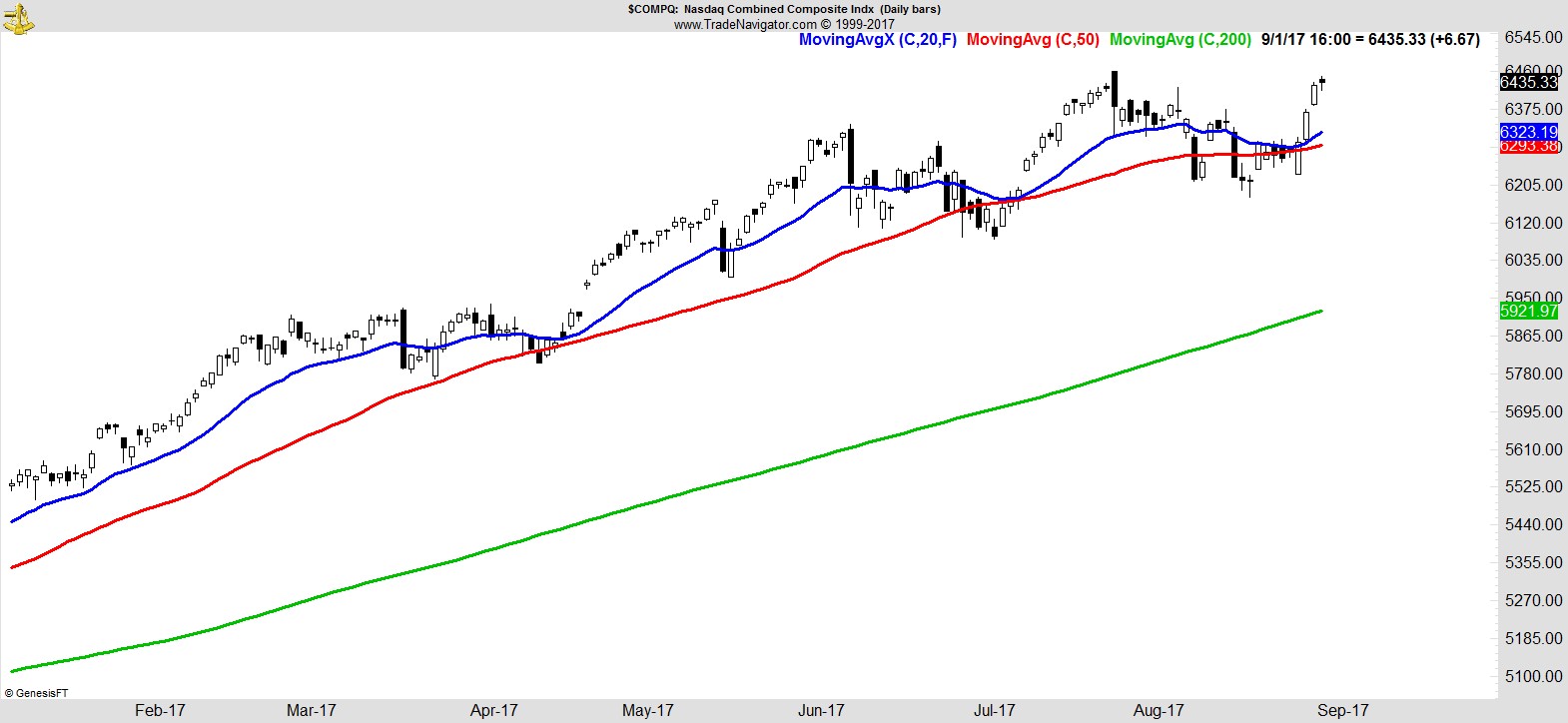

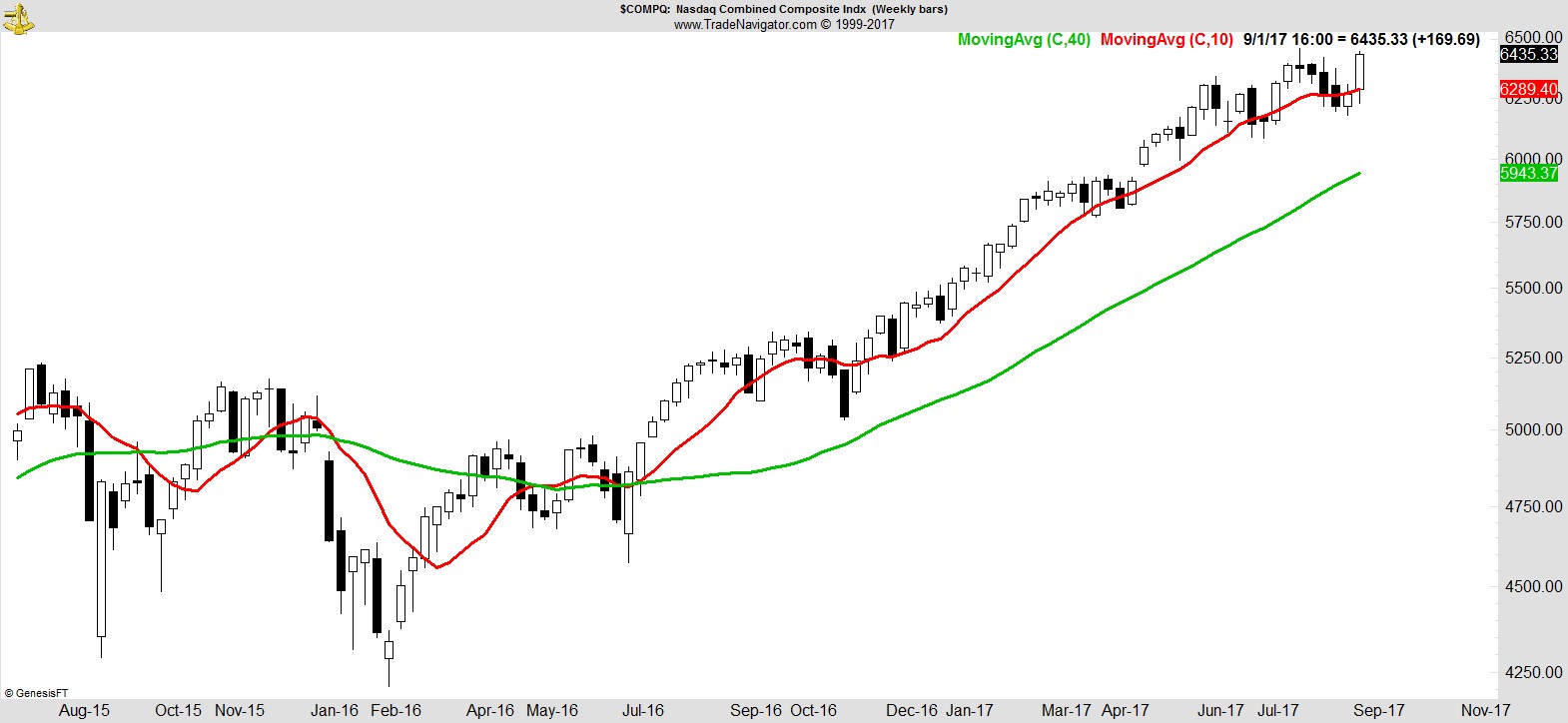

Equity markets moved back to their highs this week, led by strength in technology, healthcare, and materials. Breadth has improved significantly, while sentiment has become more bearish as we enter what has historically been one of the weakest months of the year.

The S&P 500 finished just shy (-0.18%) of an all time high on a daily and weekly close basis, while the NASDAQ had no such trouble, hitting all time highs as tech, biotech, and small caps outperformed.

.

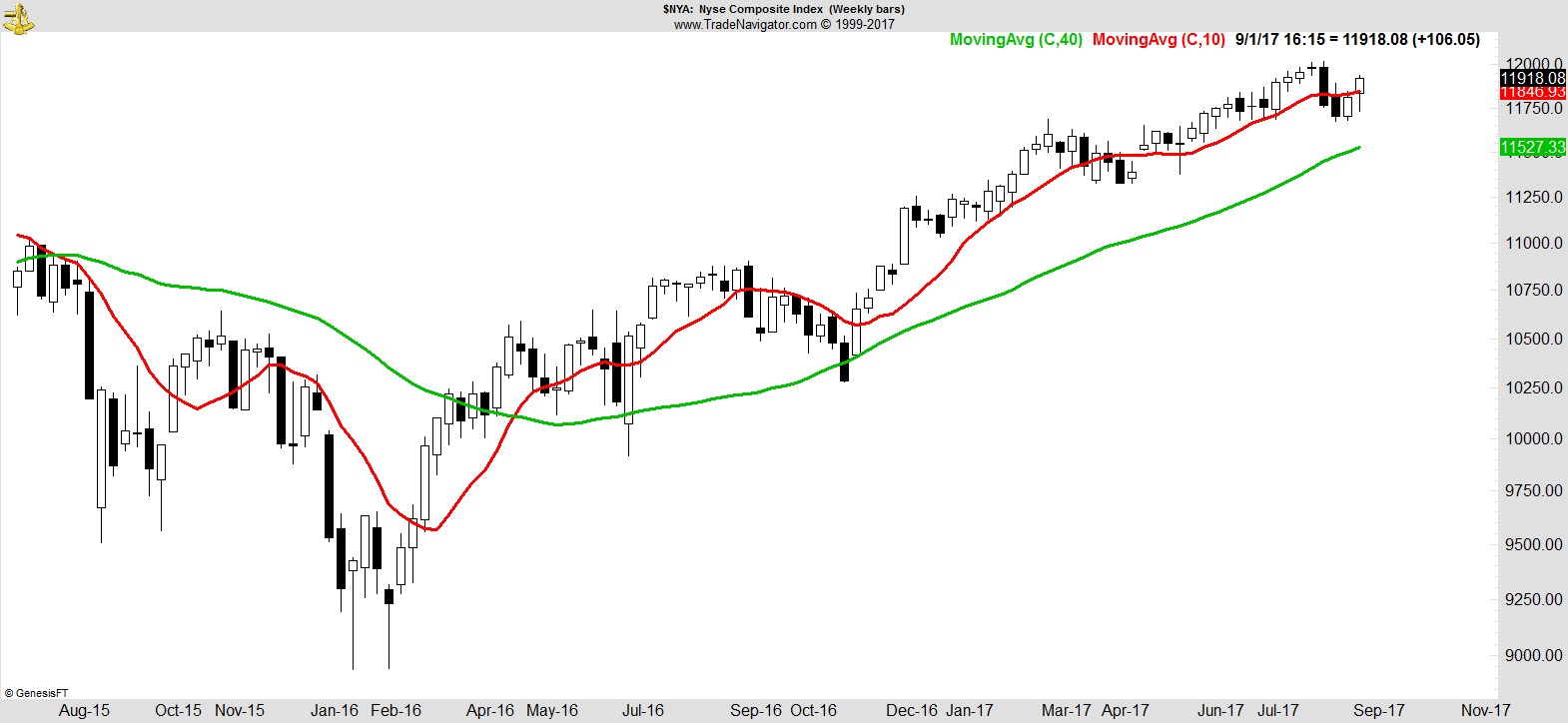

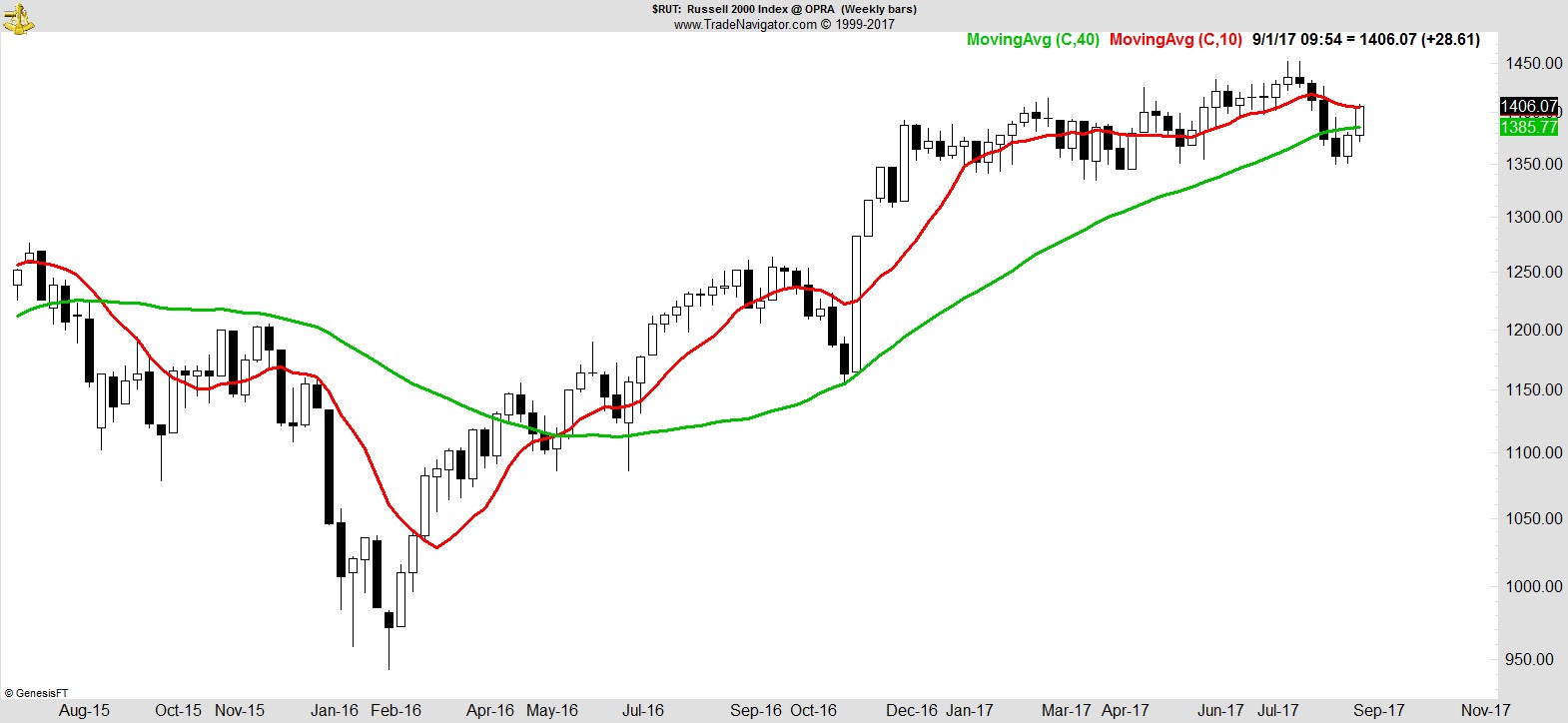

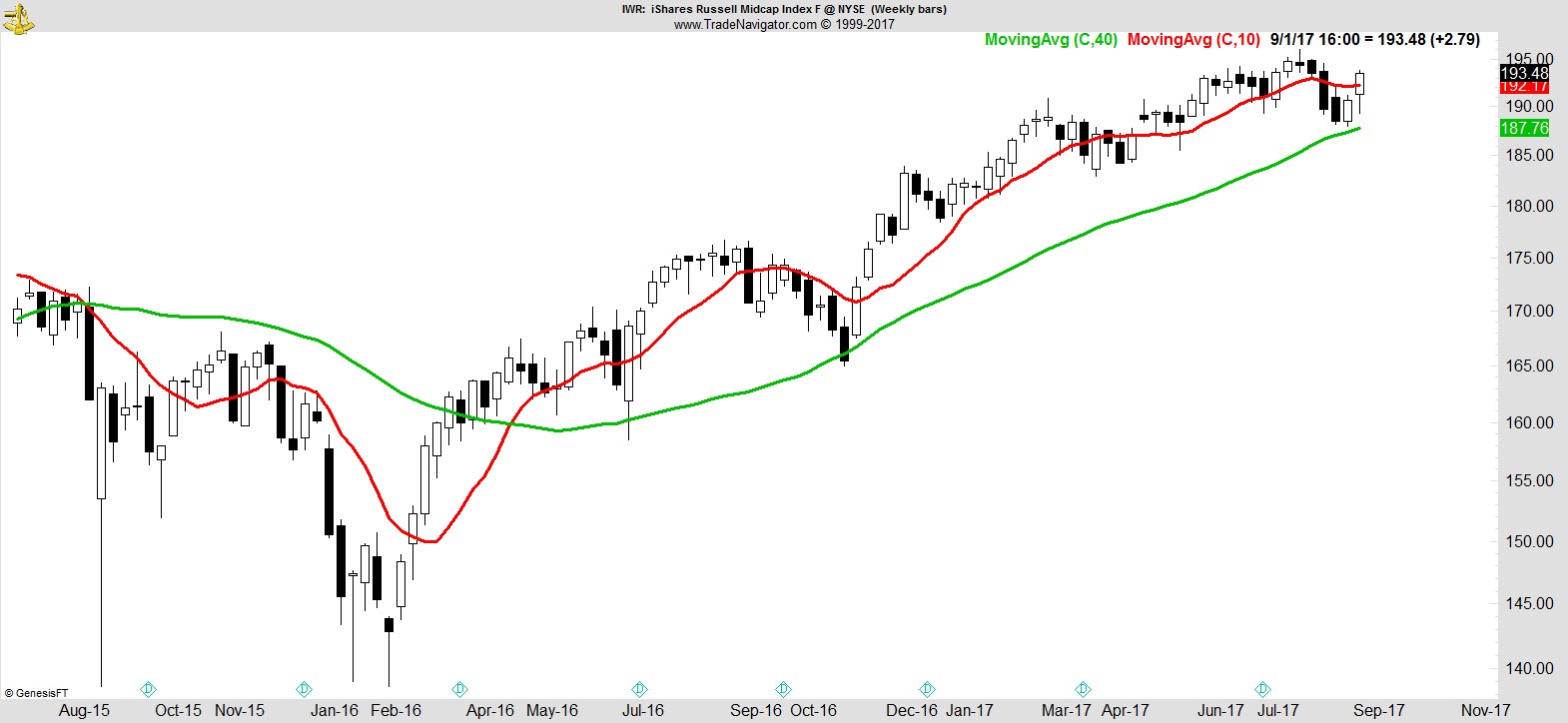

The NYSE Composite, Russell 2000, Midcap, and Microcap indices all moved back above their 10-week MA.

.

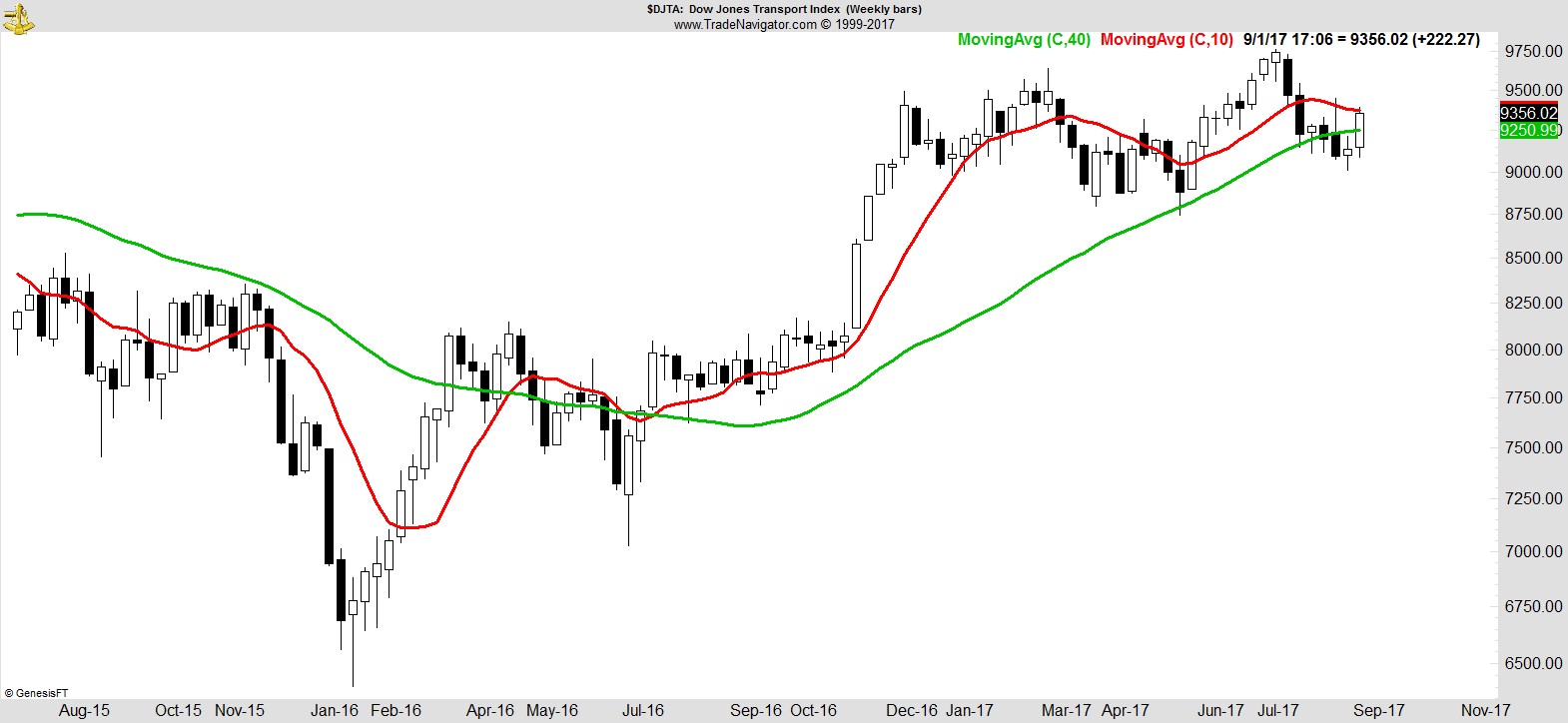

The Transports is the only major index below its 10-week MA.

.

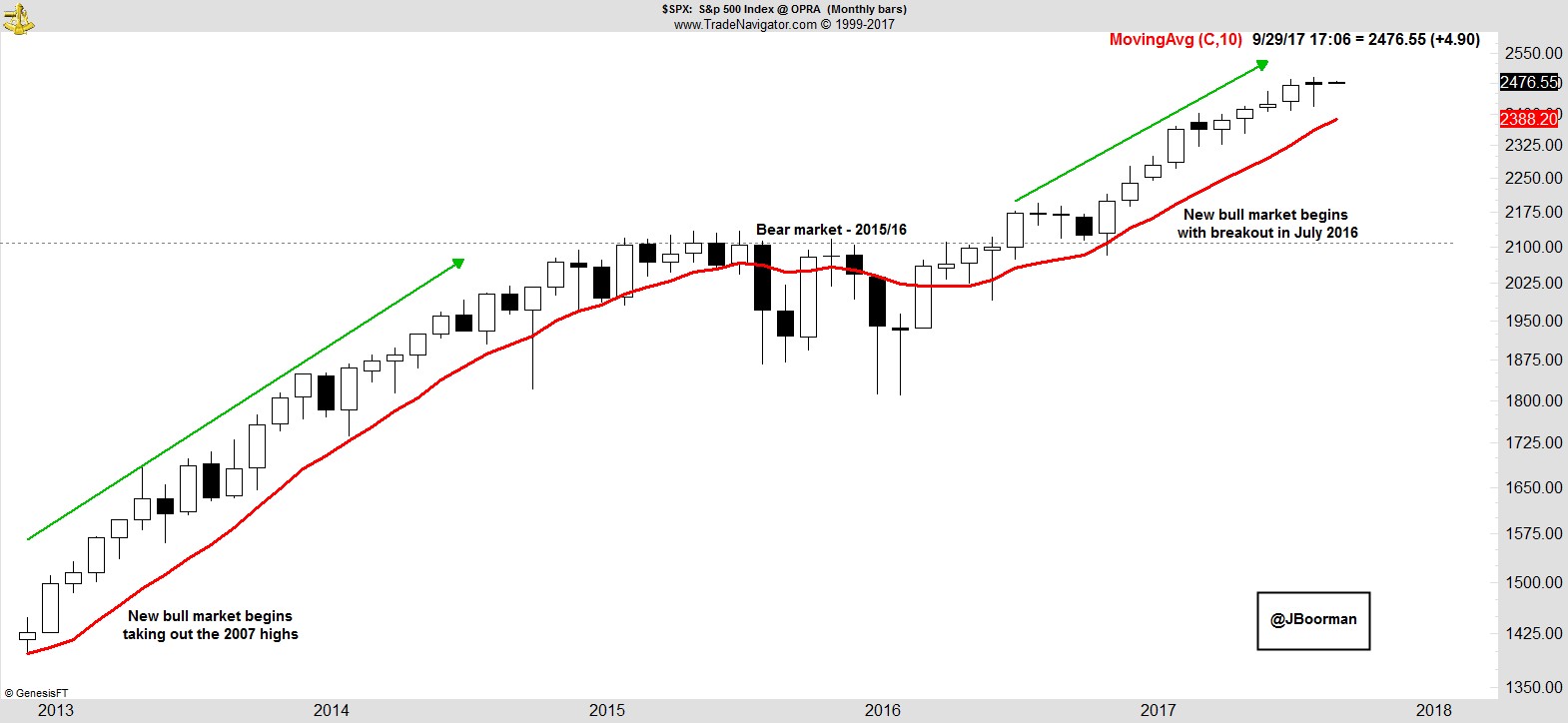

Thursday brought August to an end, and put another positive monthly close in the books, as well as another higher high and higher low in place. Here are the S&P and Dow on monthly charts.

.

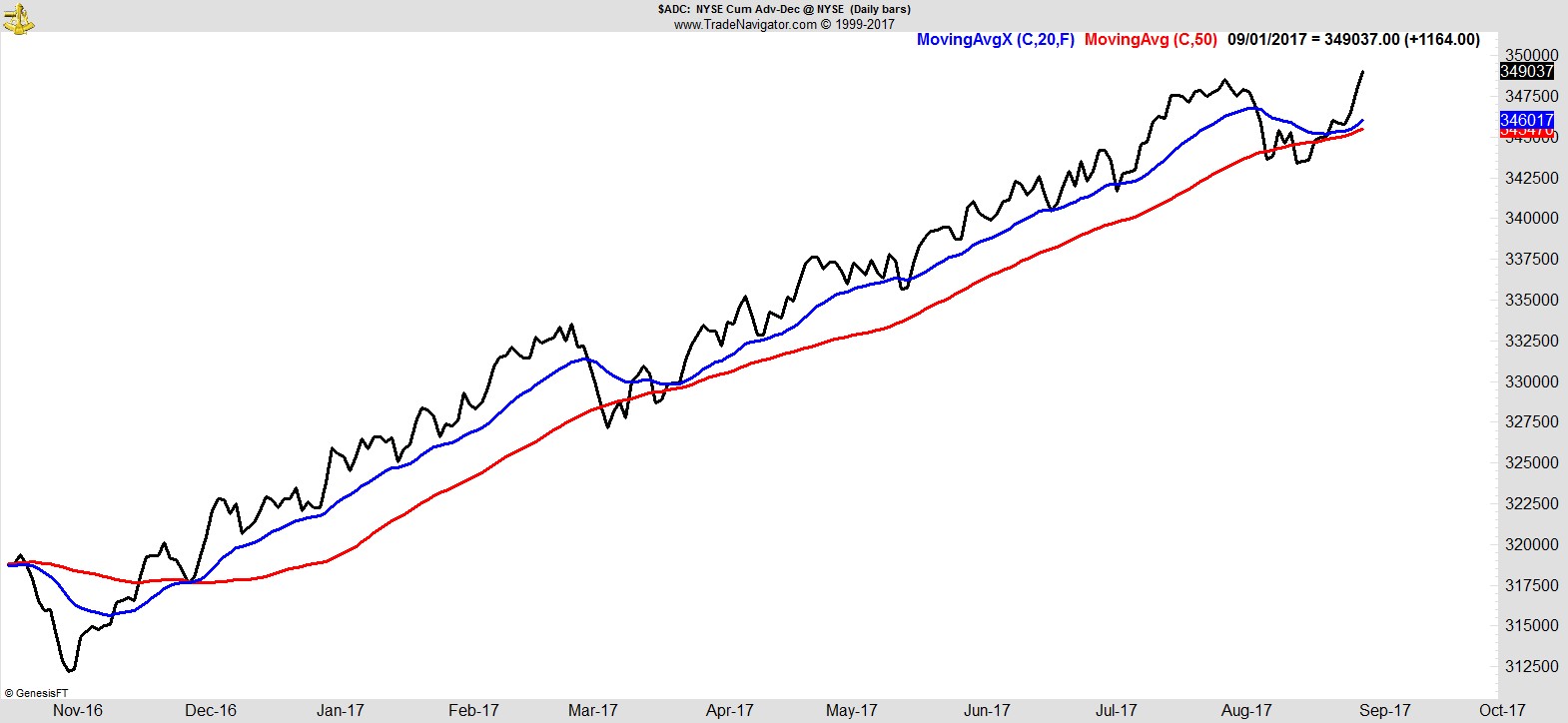

Breadth improved throughout the week, with the NYSE Cumulative Advance/Decline finishing at all time highs.

.

It's well known that September is historically the weakest month of the year, and that crashes have occurred in October. As summer comes to an end, sentiment has become decidedly negative, with the AAII Survey showing the percentage of bullish respondents dropping to 25%, and those bearish rising to 40%, making it the second most pessimistic reading this year.

All told, the deterioration in breadth that occurred throughout August is over. What was initially a short-term downtrend in many stocks that looked as if it could easily morph into something more serious, with many sectors other than traditionally defensive ones below their 50-day, now appears to have been another sector rotation where the major indices mask the damage underneath, only for the market to ultimately resolve higher and resume its longer-term uptrend.

.

Sector Analysis

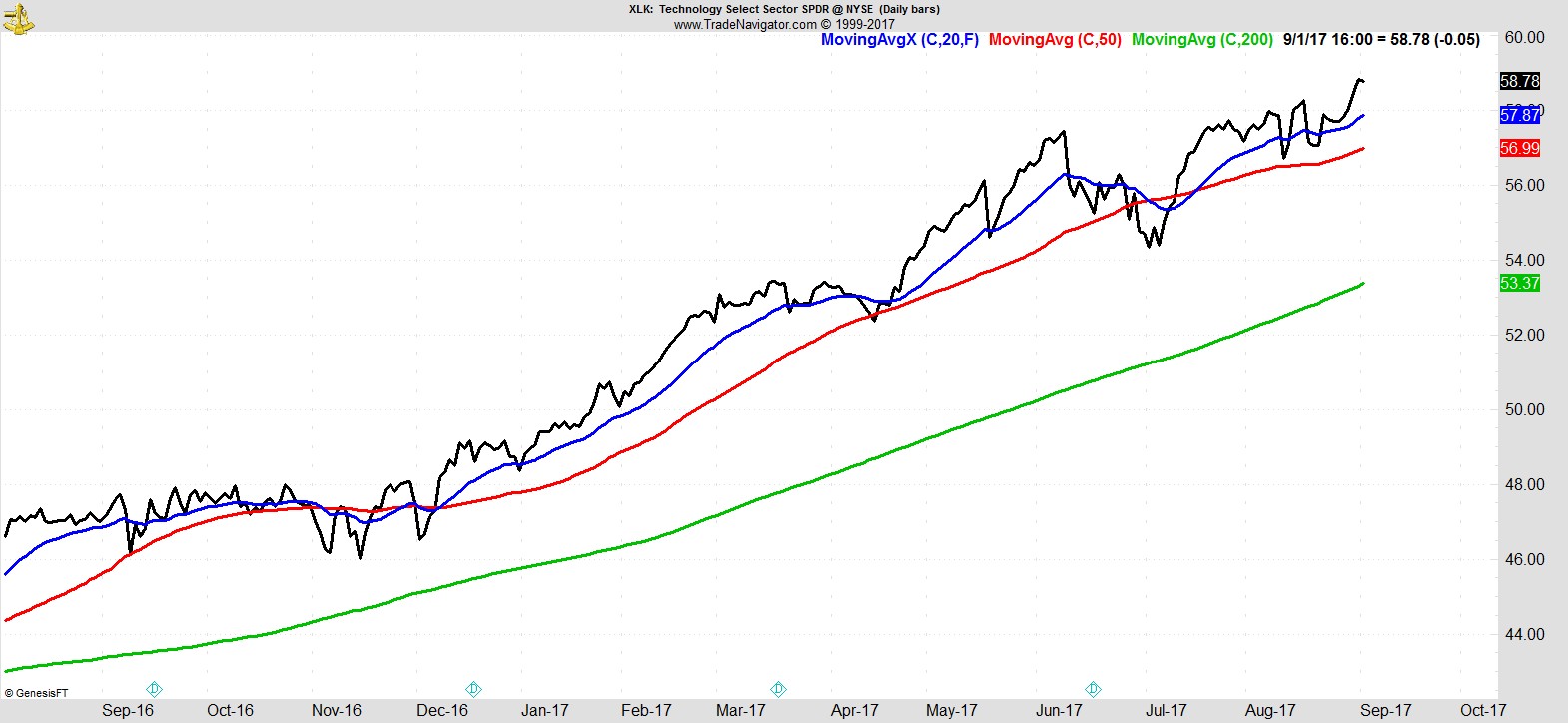

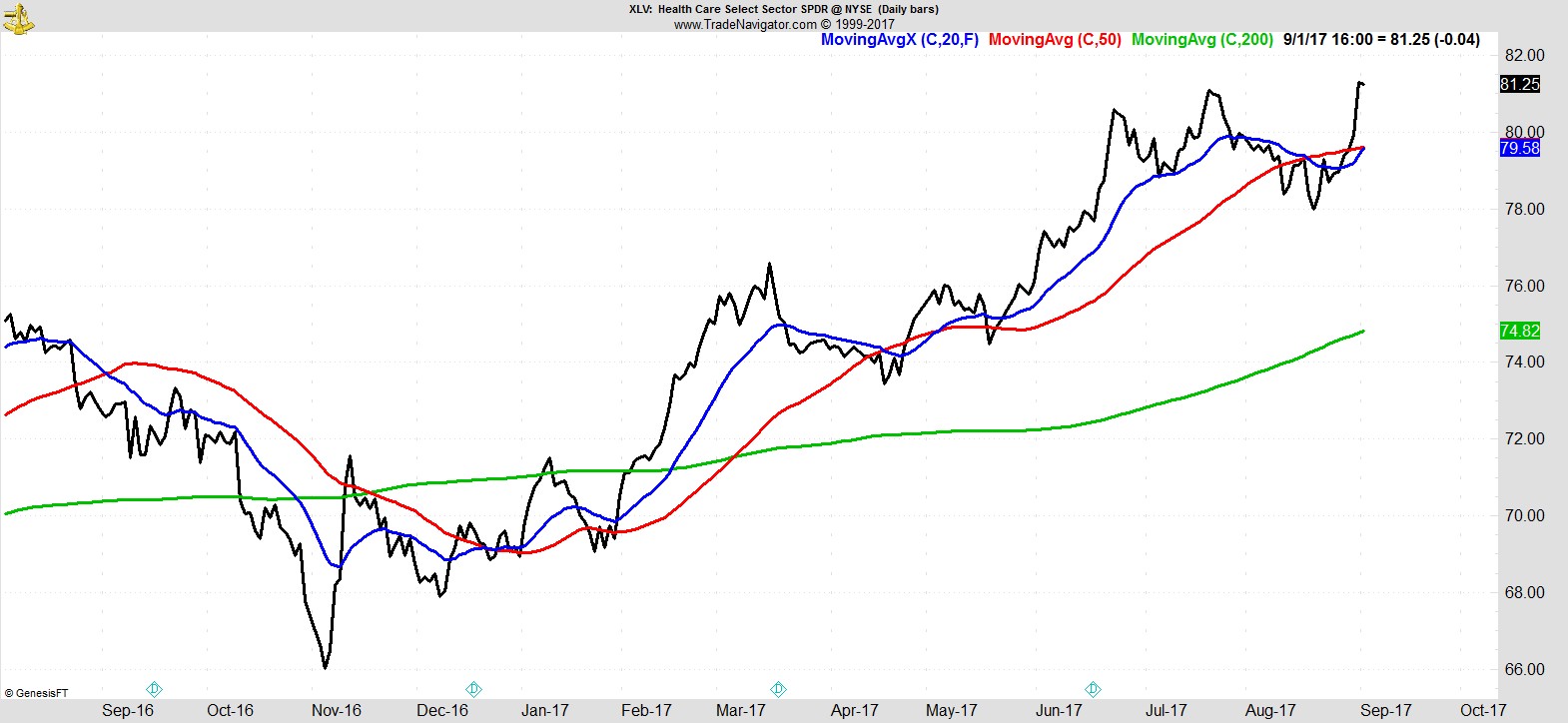

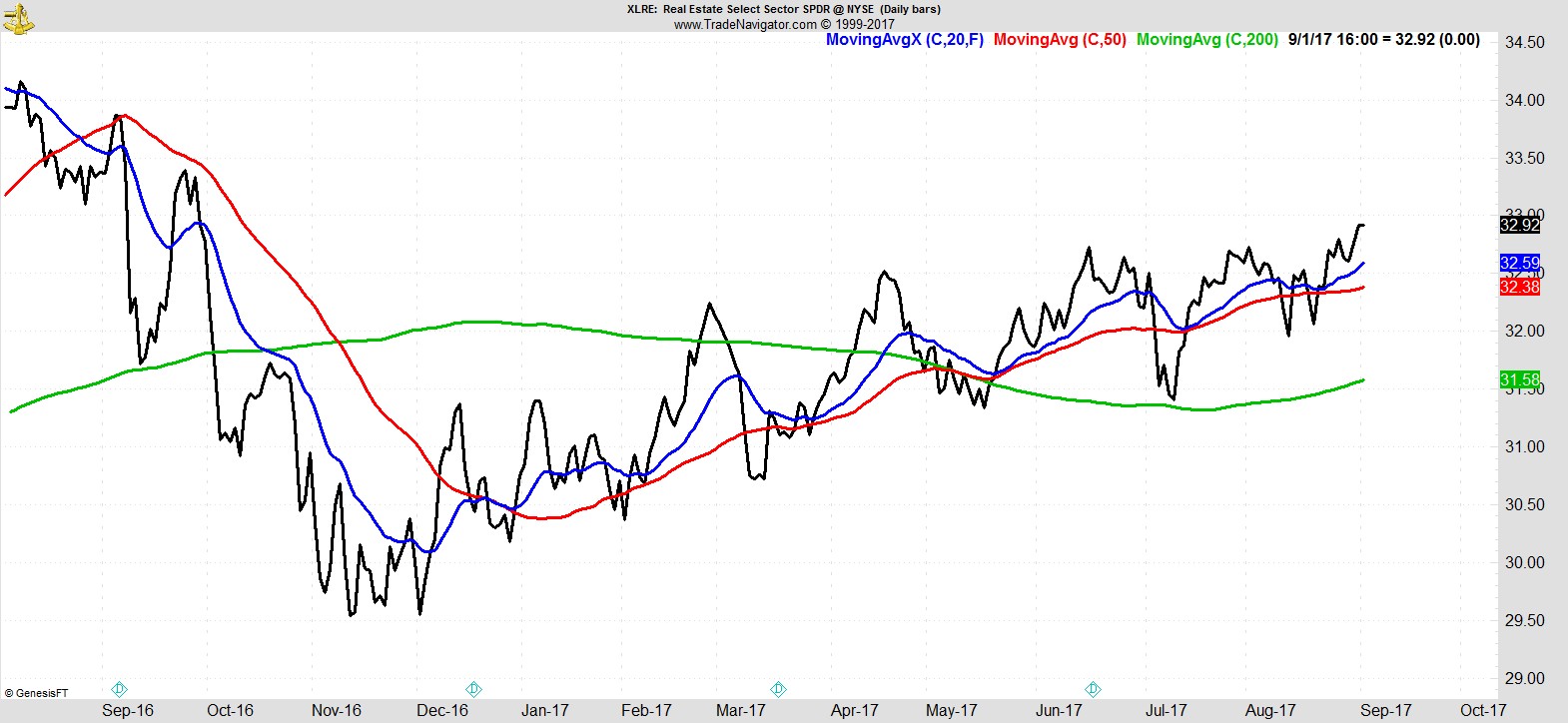

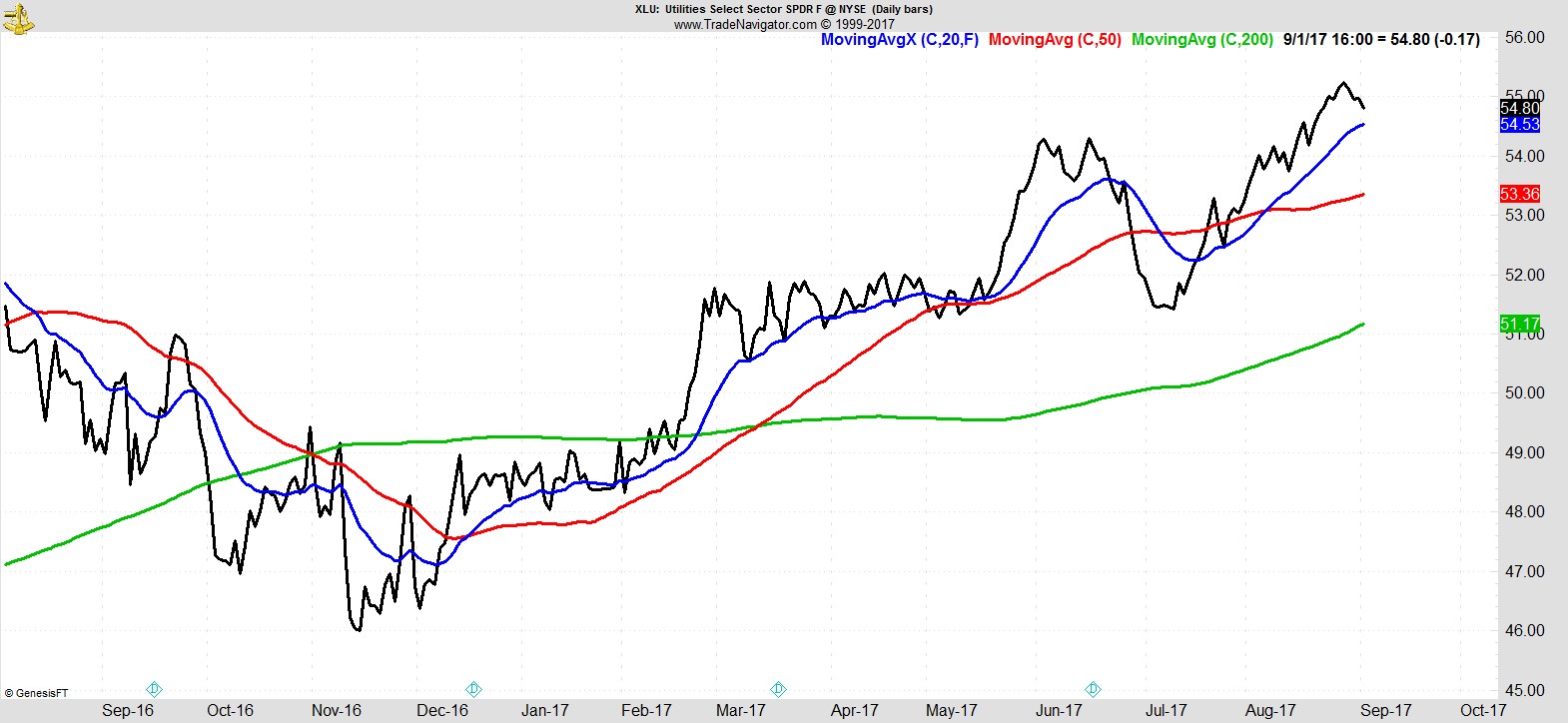

Technology and Healthcare both moved to all time highs this week, and are the two leading S&P Sector SPDRs. The former front-pair Real Estate and Utilities are just behind and still going well.

.

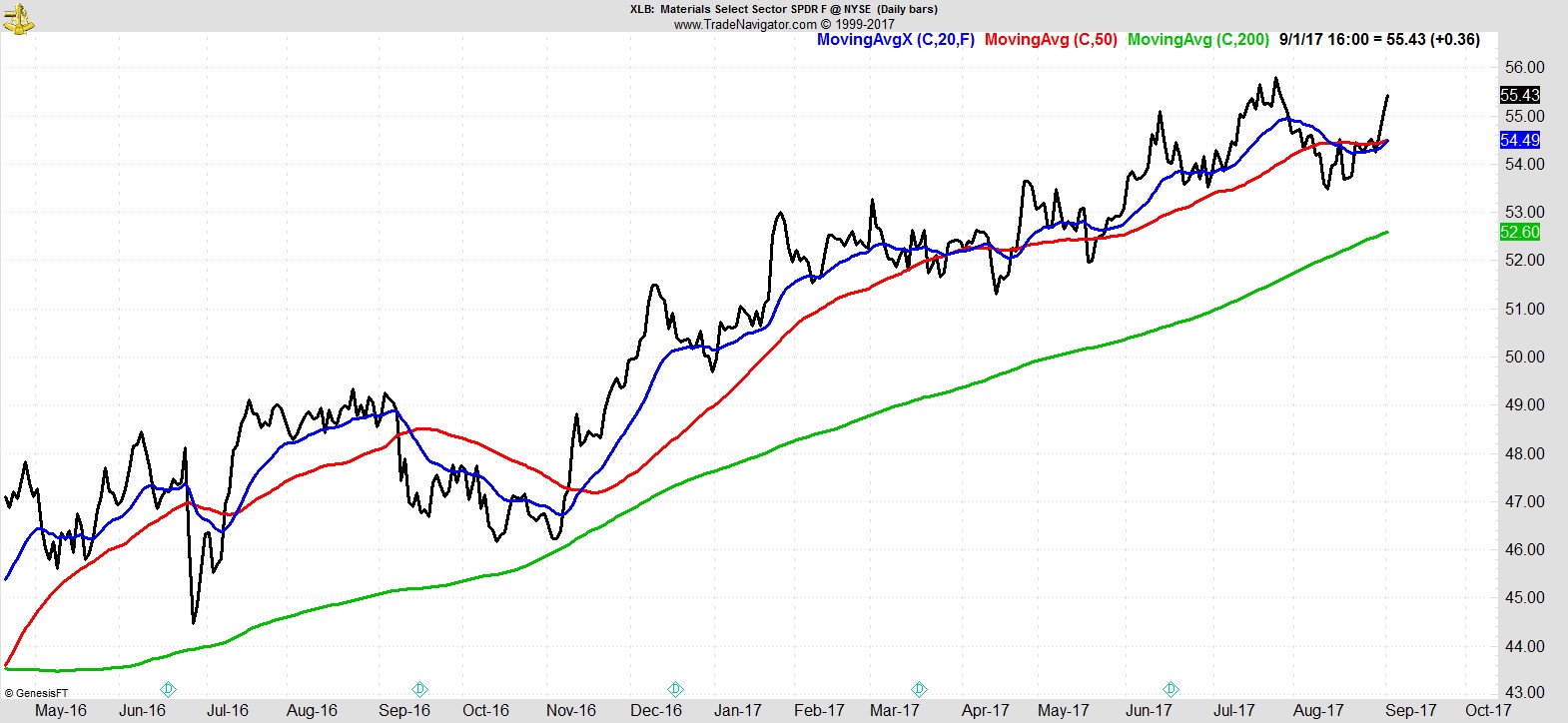

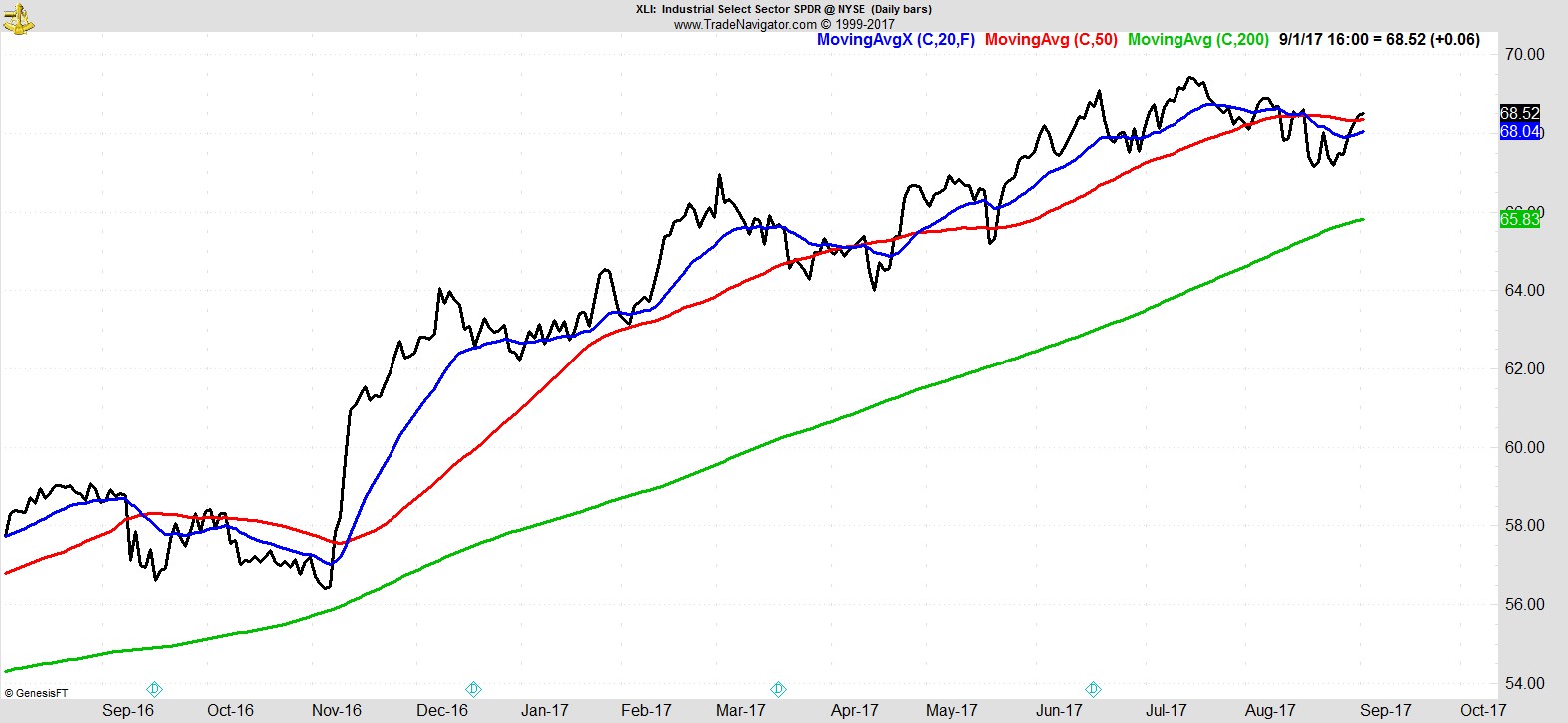

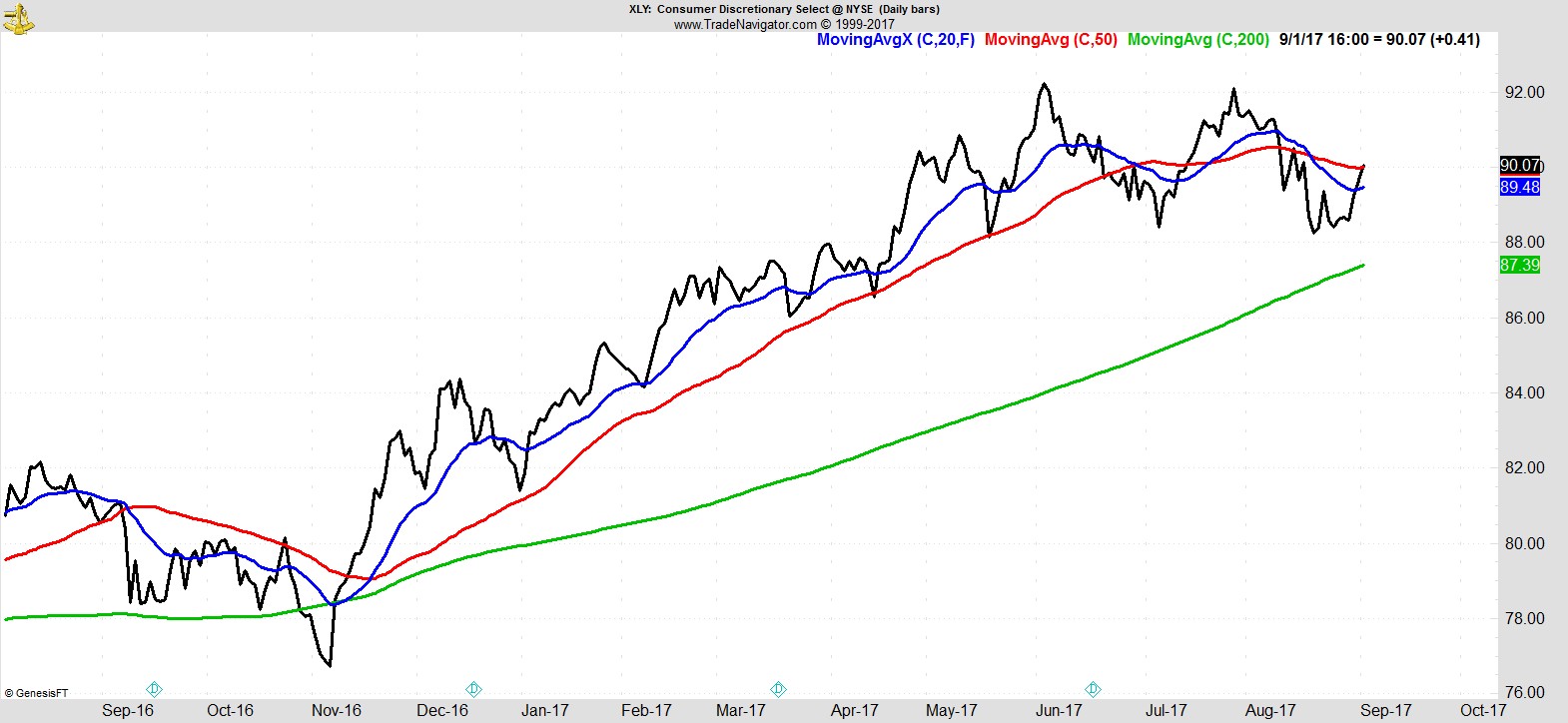

They're followed by Materials, Industrials, and Consumer Discretionary. All are back above their 50-day MA.

.

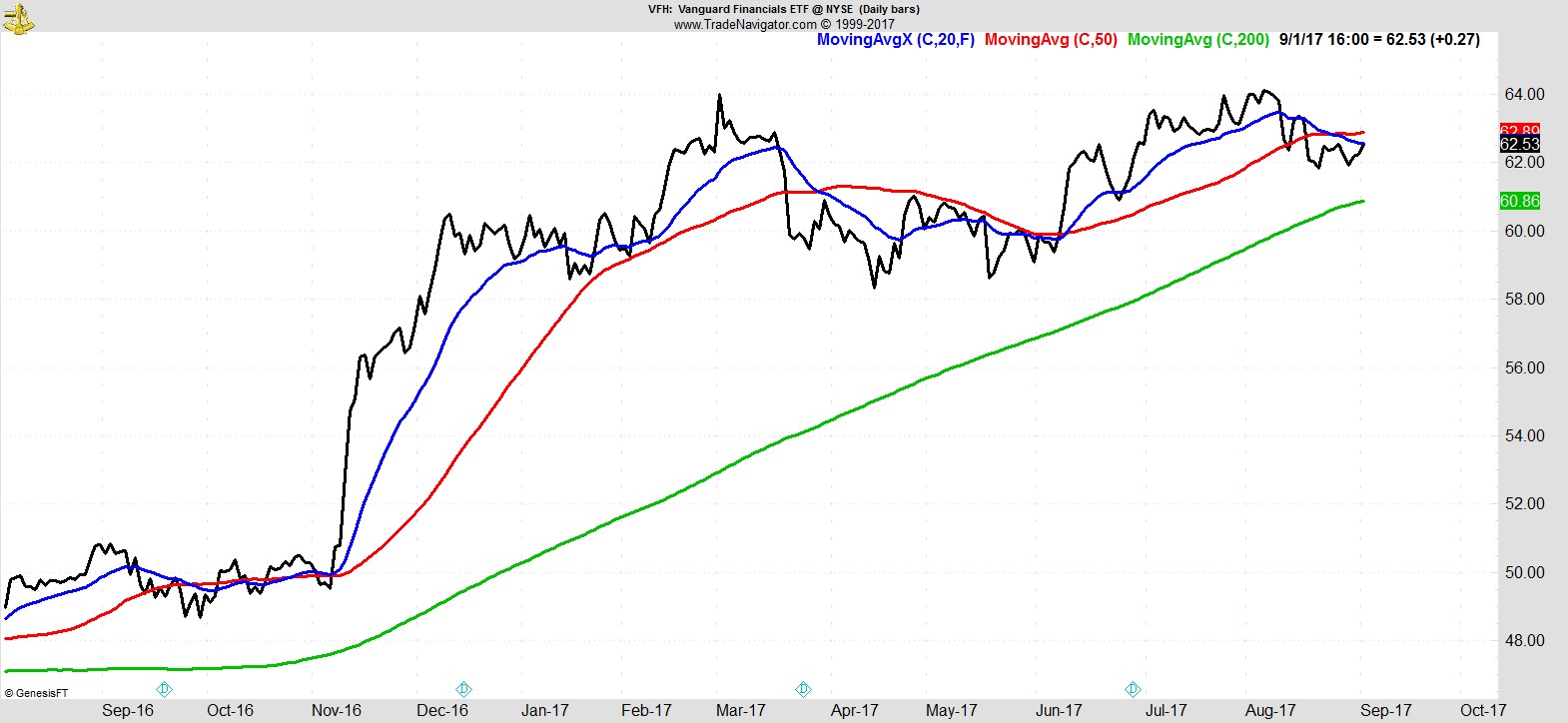

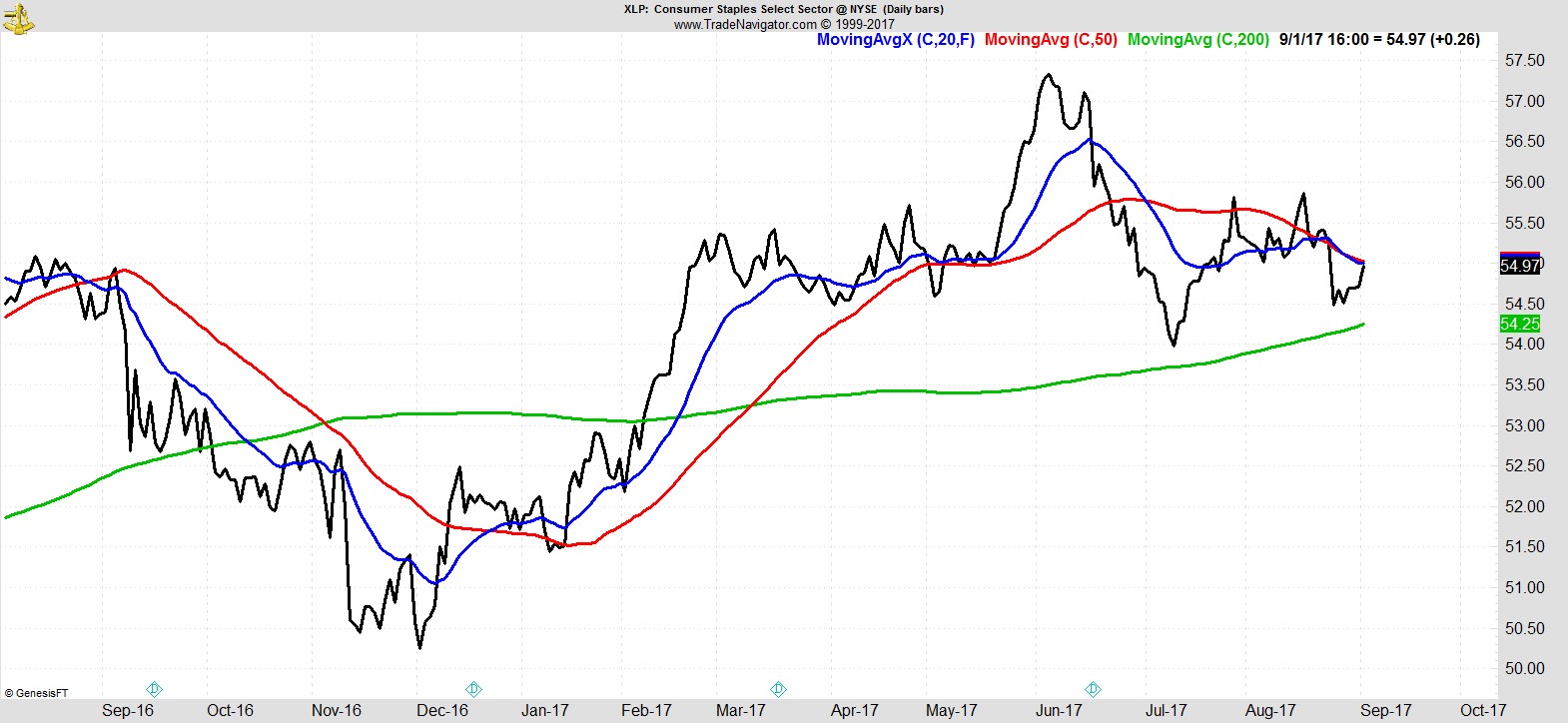

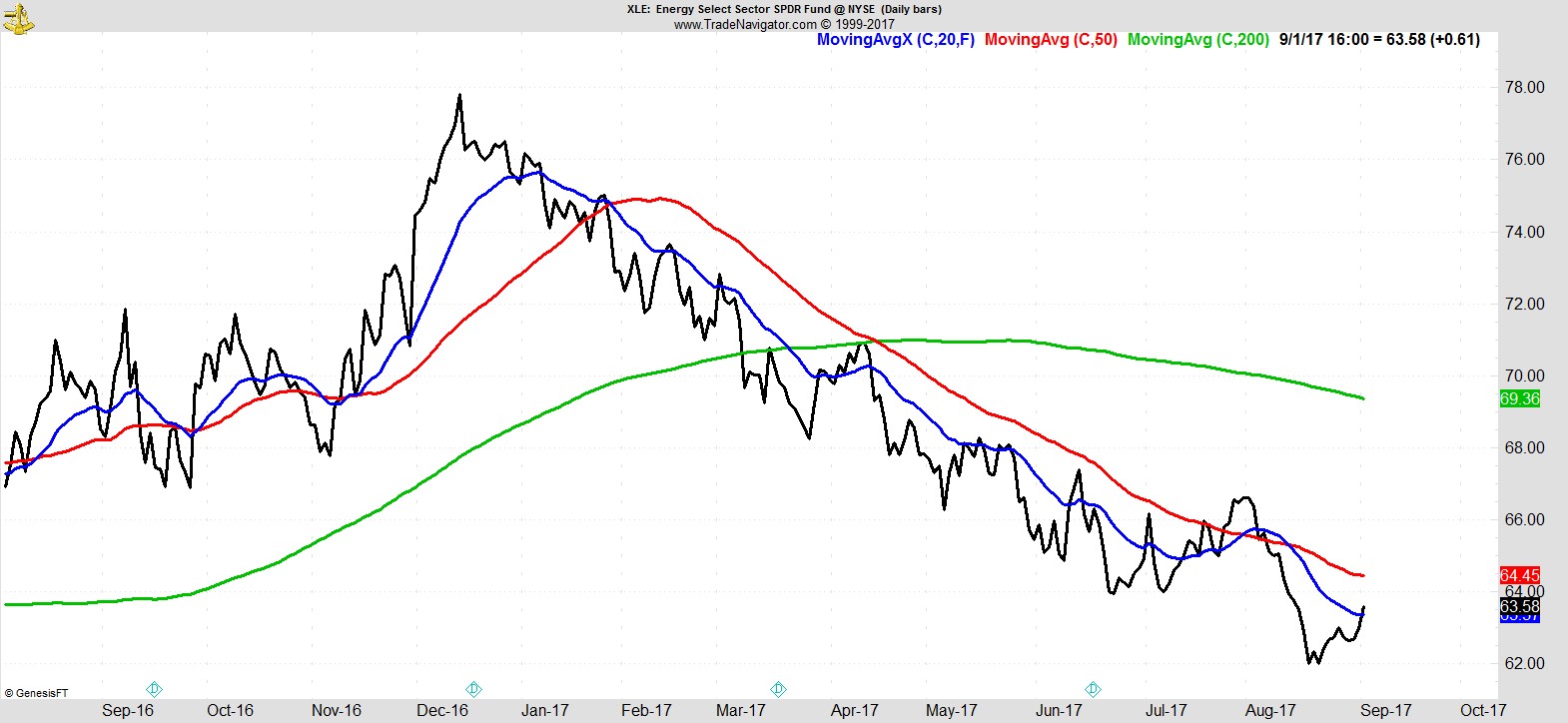

The only three below their 50-day are Financials, Staples, and Energy, but even then I would argue they're all improving, putting higher lows in place this week.

In the case of Energy, although it's had plenty of false dawns, I find it interesting that this most recent rally is in the face of bad news. Even if you don't believe the impact from Harvey has a specific knock-on effect to energy stocks rather than energy prices or futures markets, you'd have to concede the sentiment around the sector is overwhelmingly negative.

I've seen headlines like "Harvey's Impact On The Energy Market Will Be Substantial" and "Energy Stocks Pummeled As Harvey Dumps More Rain On Texas." Really? The sector had already been rallying for five days straight the week before the storm hit, it fell modestly without making a new low in the immediate aftermath, and has since risen further to close at 3-week highs.

Price will be the final arbiter as always, but when a sector (or an individual stock) rallies on bad news it tells me a significant low may be in place, and in terms of the sentiment and reaction so far, that could easily be what we've witnessed this week. And it doesn't mean we need to go catching knives and buying stocks in downtrends either. Stick with what's already leading as the sector turns. This week we've seen $VLO and $COG breaking out to 8-month and 2-year highs respectively.

.

Alpha Capture Portfolio

Our model portfolio climbed +1.6% on the week vs +1.4% for the S&P. It had two new entry signals during the week, and this weekend has one exit signal, and three additional entries. That will bring it up to 11 positions, total open risk of 6.5%, and 9% cash.

.

Watchlist

The continued improvement in breadth is reflected in our list this week with many sectors accounted for, but it's healthcare and technology that are leading the way.

Here's a sample from the full list of 20 names:-

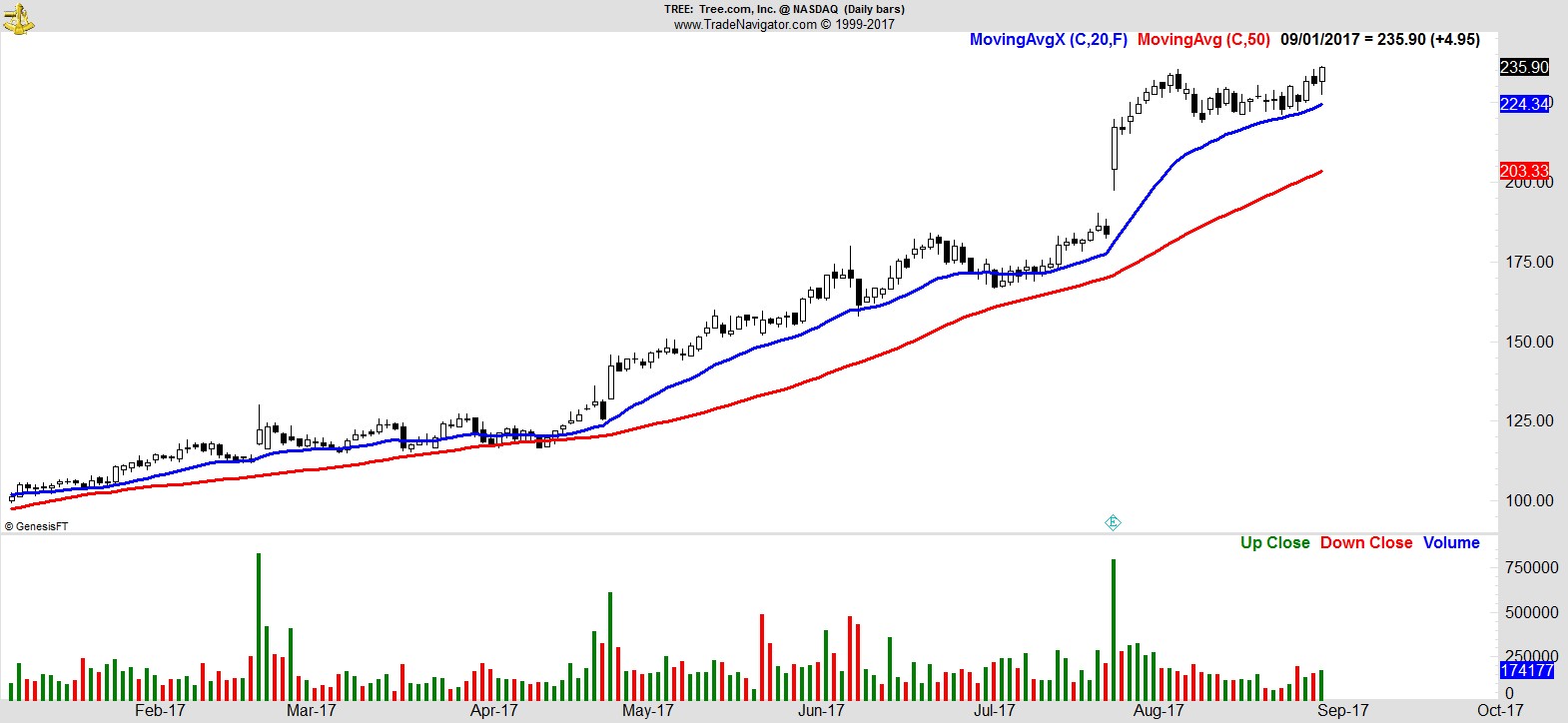

$TREE

.

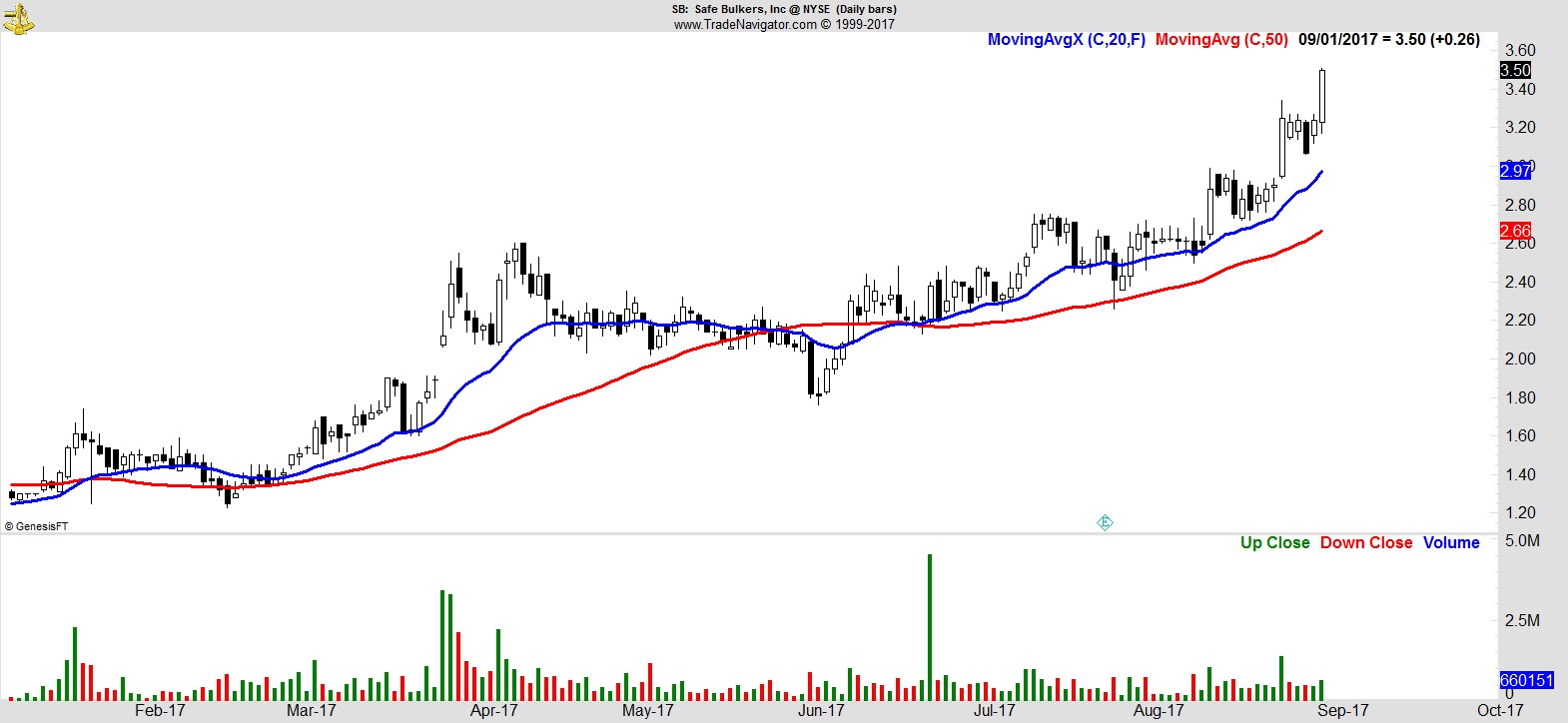

$SB

.

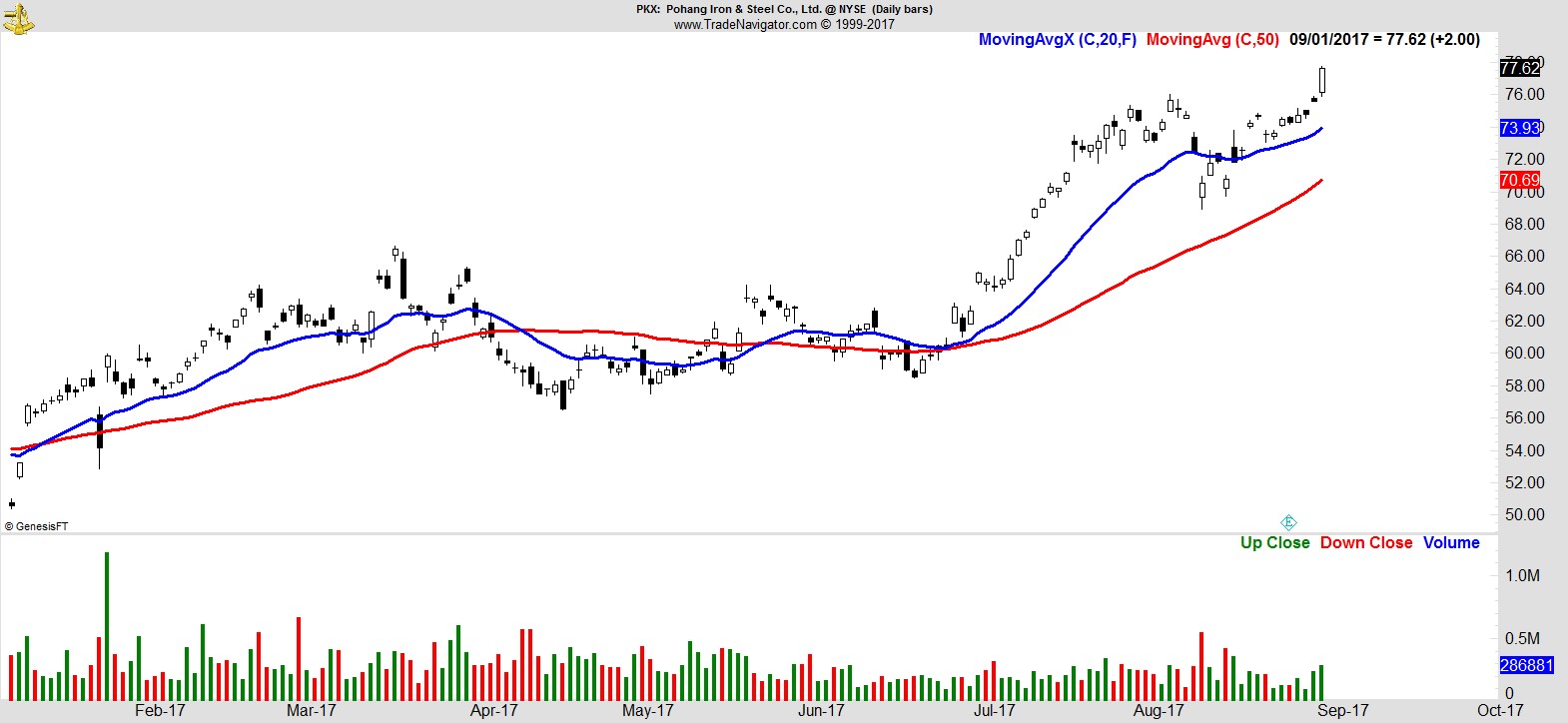

$PKX

.

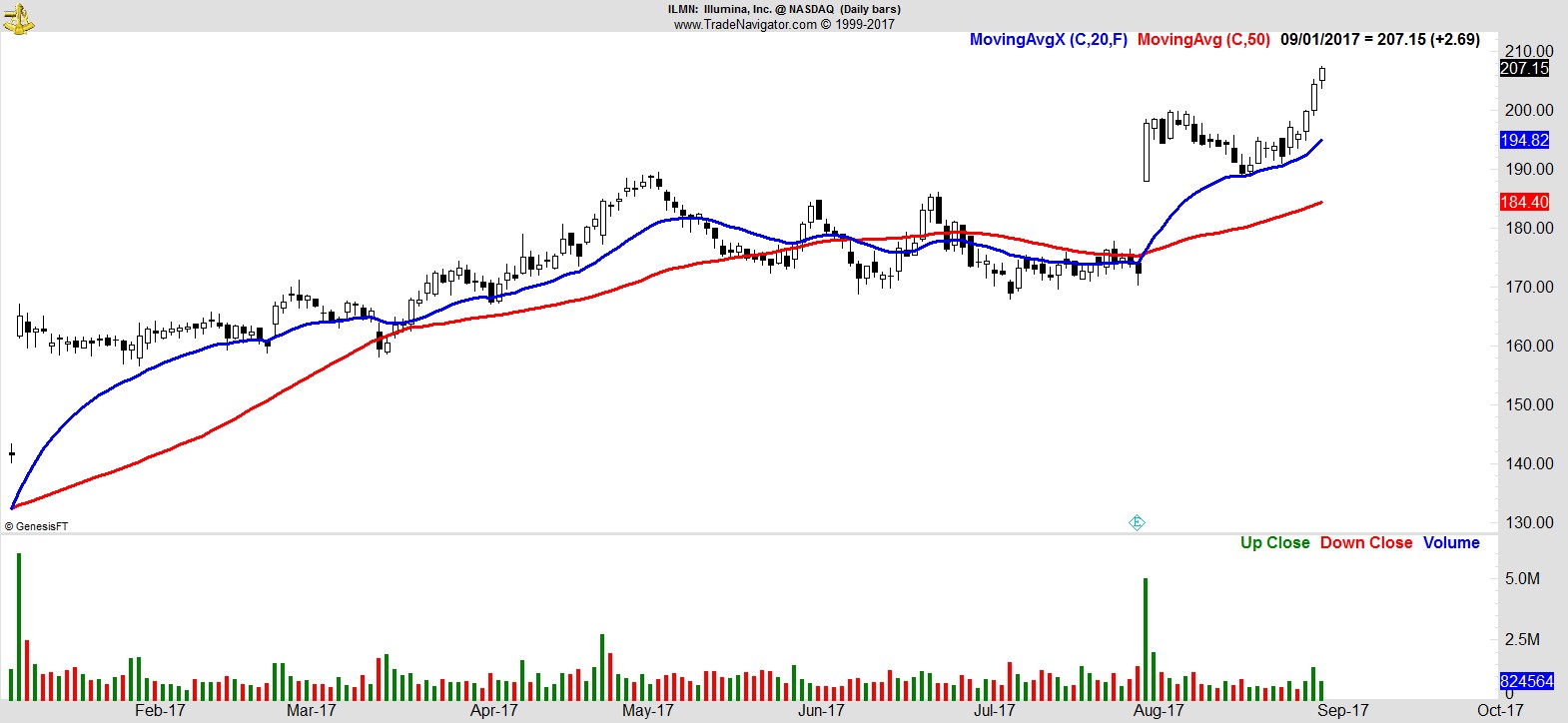

$ILMN

.

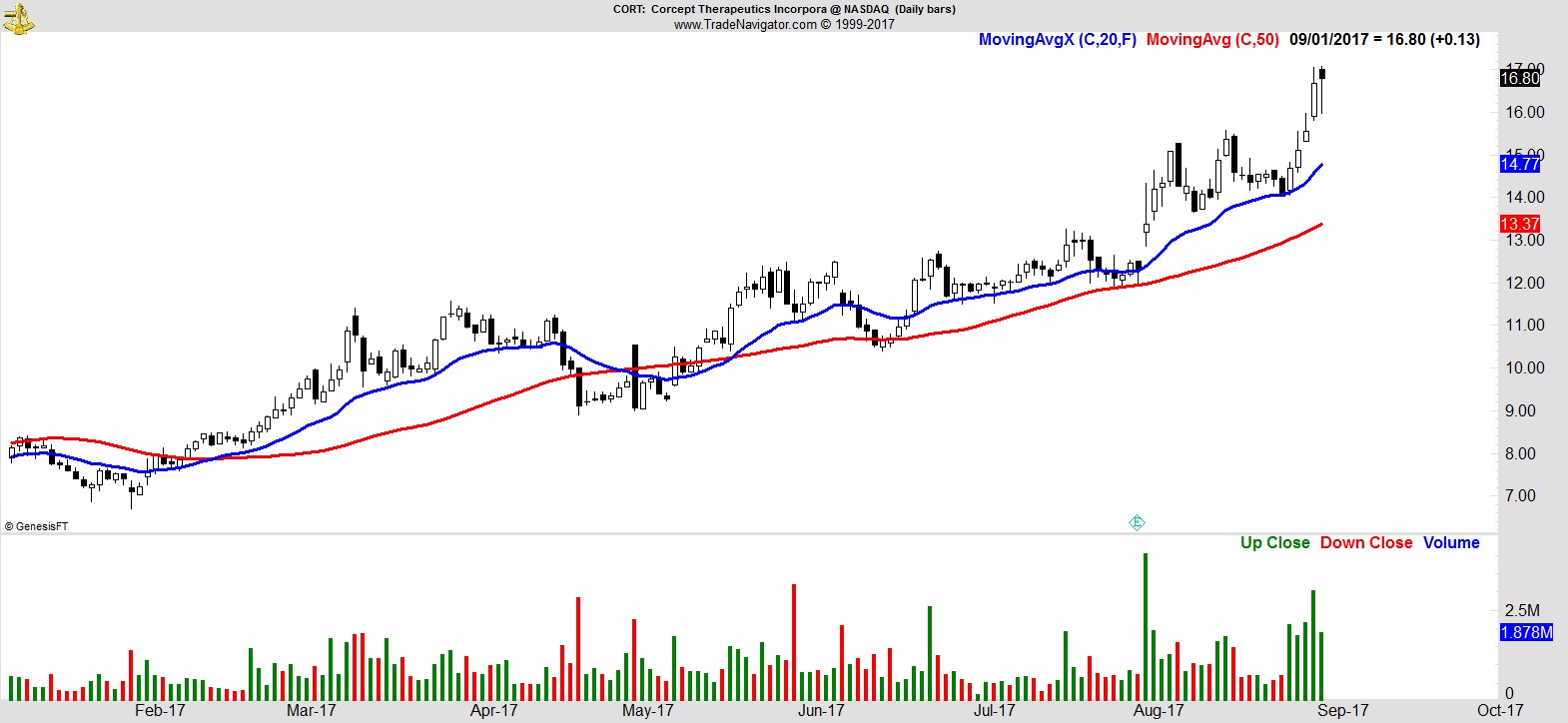

$CORT

.

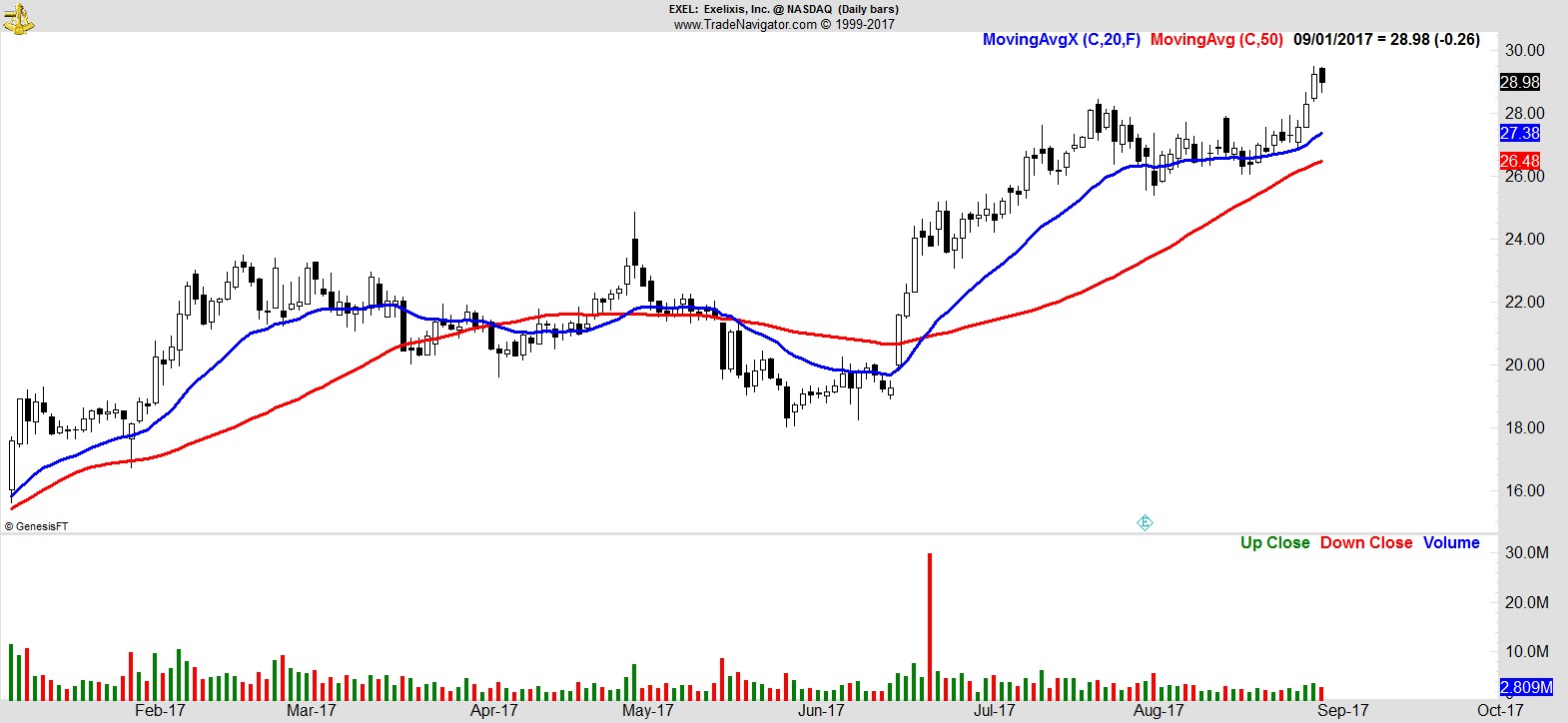

$EXEL

.

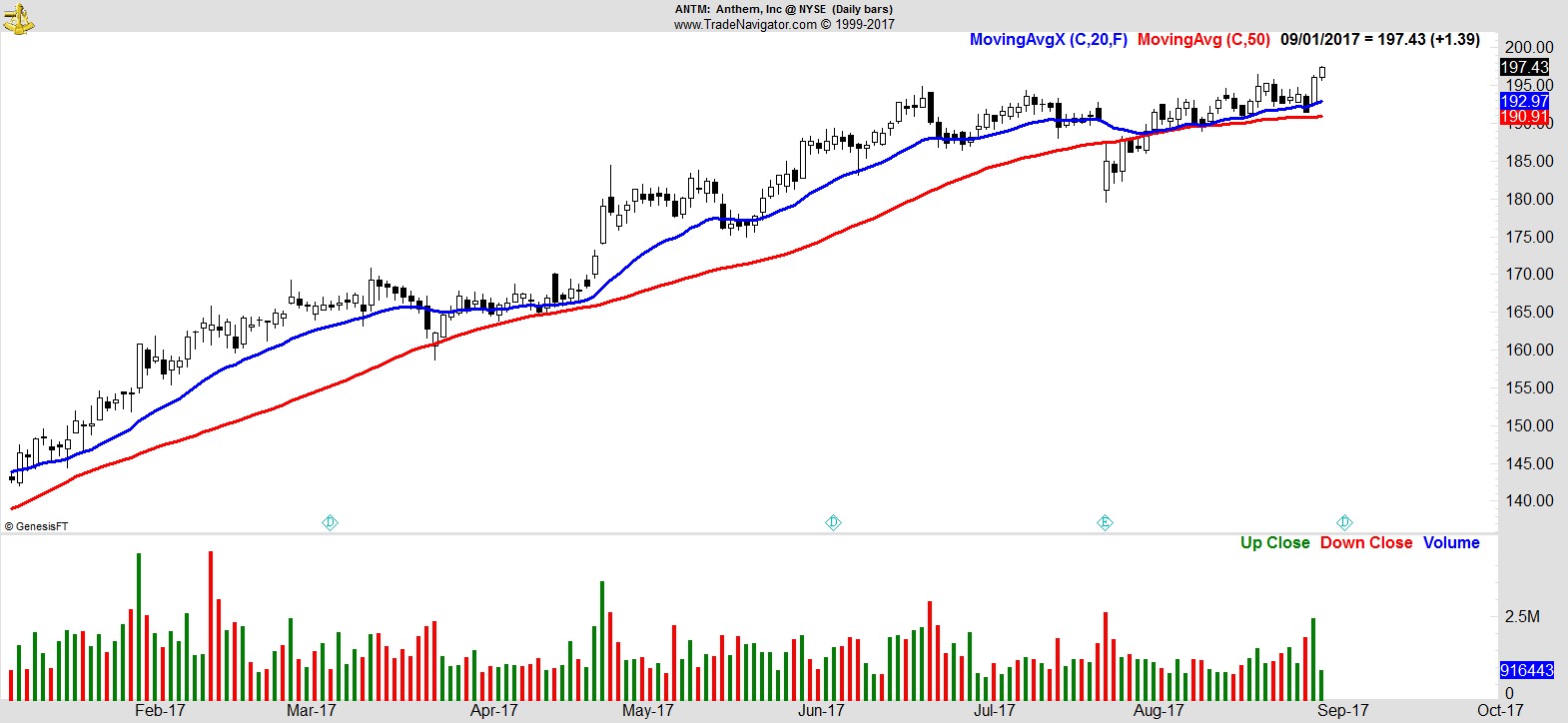

$ANTM

.

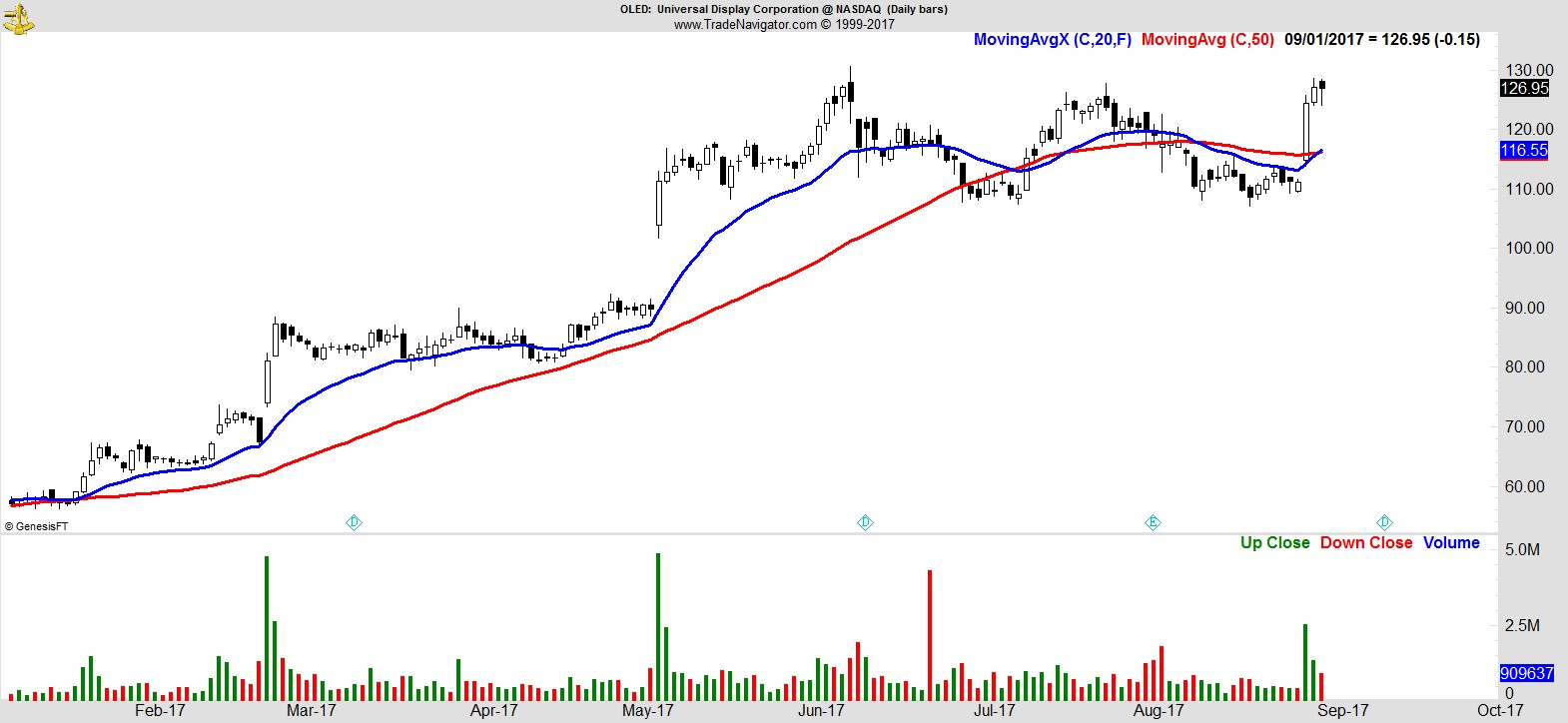

$OLED

.

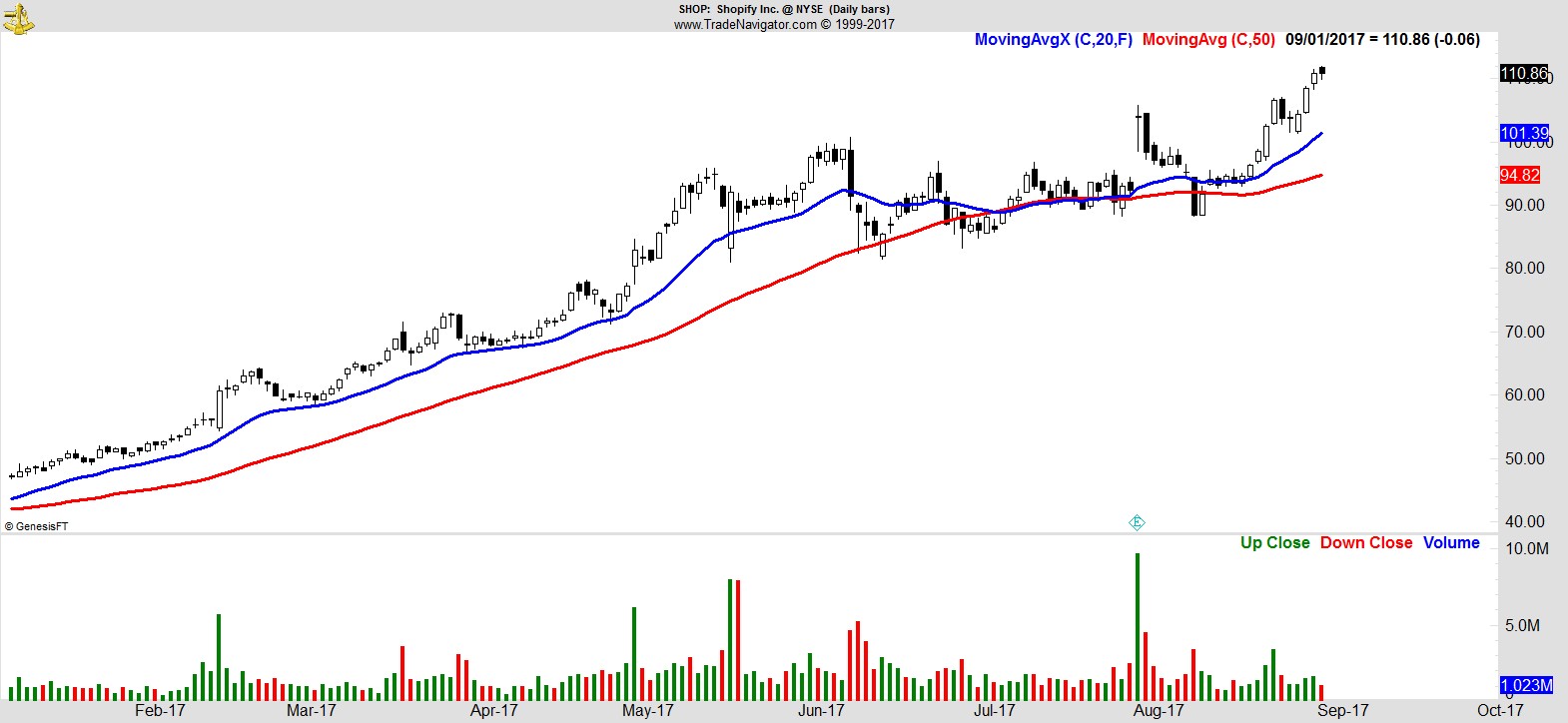

$SHOP

.

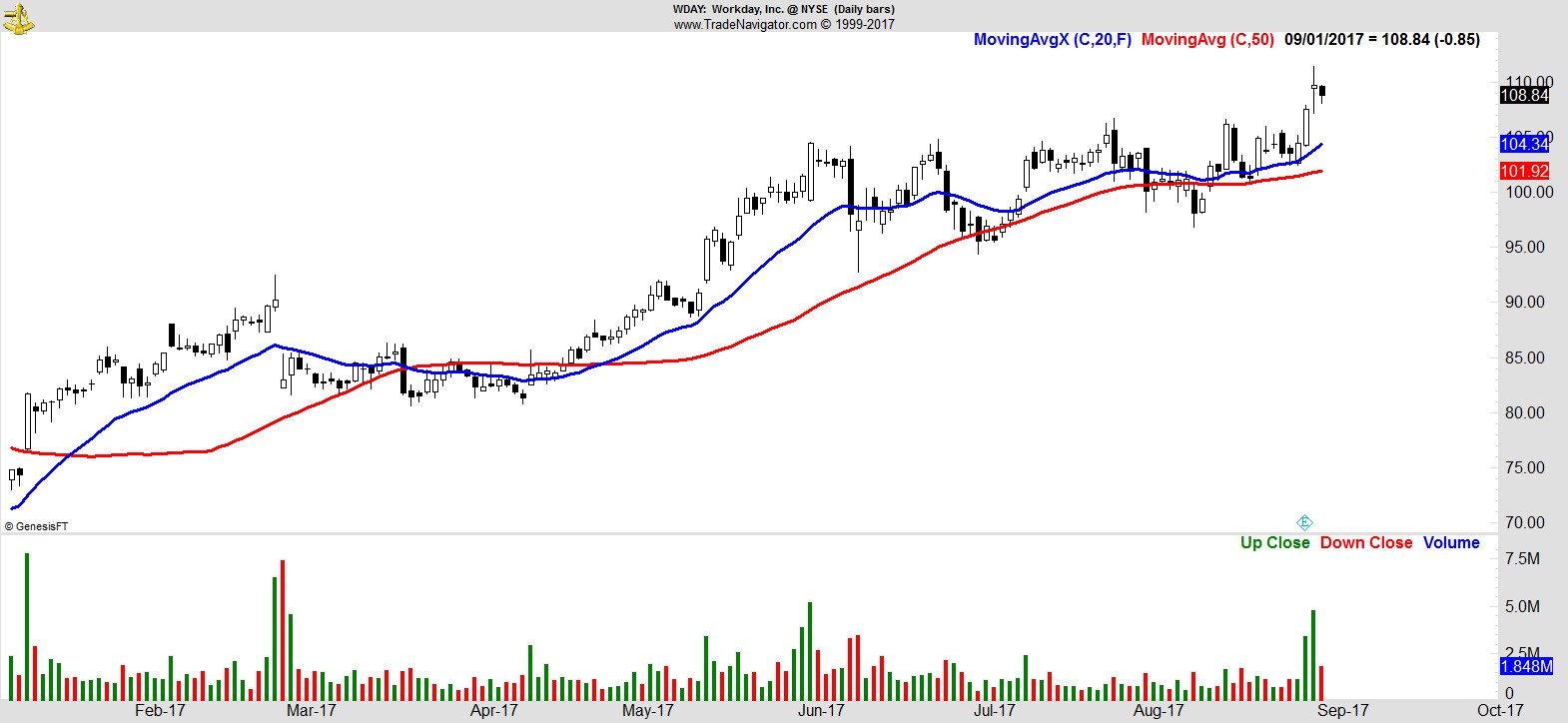

$WDAY

.

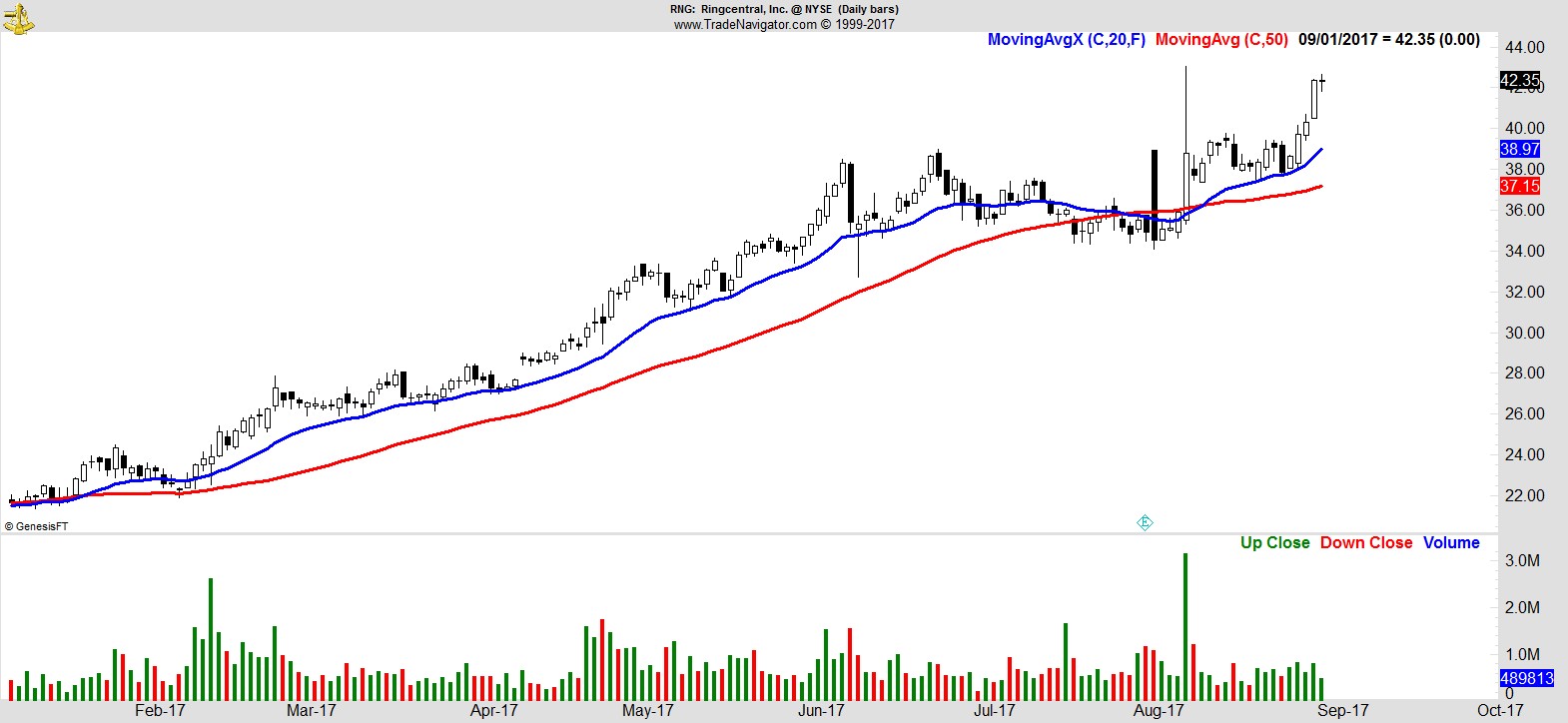

$RNG

.

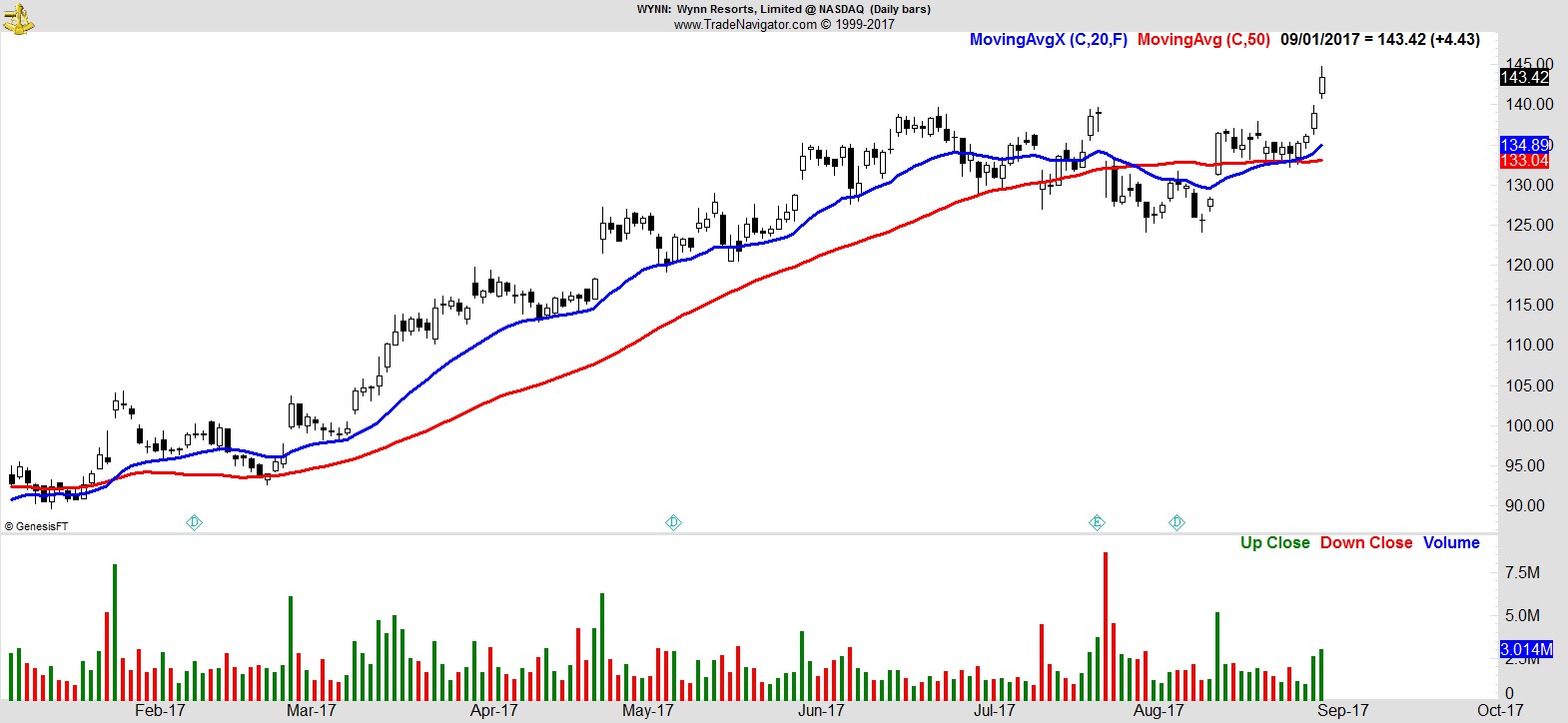

$WYNN

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 8/26/17

Weekend Review and Watchlist

— 8/26/17