One of my favorite Wall Street clichés relating to stock market valuations goes something like this: "Valuations don't matter until they do, and then they matter a lot."

Actually, you can probably replace the word valuations with any issue you'd like and the phrase would still work. However, since valuations continue to be a rather hot topic in the market these days, I thought I'd spend some additional time on the subject this morning.

If you will recall, we did a pretty thorough review of valuations last month. And frankly, I thought we had exhausted the subject.

However, I talk to financial advisors every single day and stock market valuations continue to be a topic that nearly everybody I chat with is concerned about. The conversation usually goes something like this... "Dave, why should we invest in stocks when valuations are so high? Why don't we just wait until the next crisis hits and then buy when prices are lower?" (Go ahead; I dare you to try and tell me these thoughts haven't crossed your mind at some point this year!)

The primary problem with the idea of selling now and waiting for valuations to improve is one of timing. The concept certainly makes sense. Sell high, buy low. What's not to like?

The issue, of course, is knowing when to sell and then when to buy. (And no, I won't be offended if you utter the word, "Duh!" right about now.) But here's a tip - implementing such a strategy based on stock market valuations ain't as easy as it sounds.

The point to this morning's meandering market missive is that the general consensus that one should sell when valuations are high and then buy when valuations have improved actually doesn't work very well. And the folks at Goldman Sachs have some statistics to prove the point.

In the October 2017 Market Pulse publication, the Goldman Sachs Asset Management (GSAM) writes...

"Our historical analysis finds that when investors sell equities at elevated valuations, such as today's, the expectation of buying at lower valuations is usually disappointed. The result is meaningful underperformance relative to a much simpler approach: staying invested."

An important point made in the report is that valuation levels can stay elevated in the stock market for extended periods of time, especially when the economy and, in turn, earnings, are growing. As such, selling when valuations are high can be problematic.

As you might suspect, GSAM provided some statistics to back up their claim.

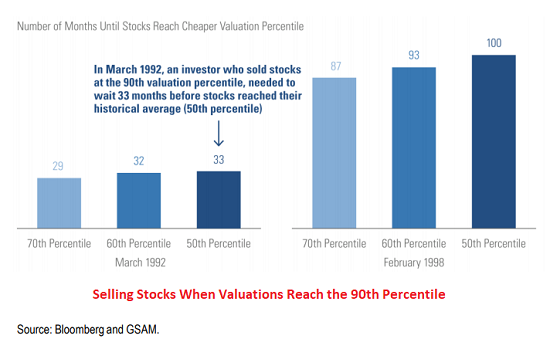

For example, GSAM says that if one decided to sell stocks when valuations - defined by the S&P 500's forward 12-month price-to-earnings (P/E) ratio - reached the 90th percentile, they would have waited a very long time before valuations reached "cheaper" levels (defined as the 50th percentile).

In the chart below, GSAM illustrates that the investor who sold at the 90th percentile in March of 1992 would have waited 33 months before valuations improved to the 50th percentile. And then if the strategy was repeated in February 1998 - a time when valuations were once again at the lofty 90th percentile - investors would have had to wait 100 months (or nearly a decade) for valuations to improve before buying back in at "cheaper" levels (assuming the 50th valuation percentile).

Oh, and for those keeping score at home, go ahead and look at a monthly chart of the S&P 500 for these buy and sell points. It will suffice to say that both buy-in spots (you know, when stocks were "cheaper") weren't exactly timely!

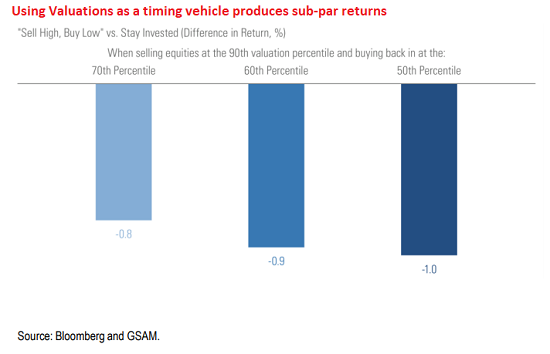

It is likely for this reason that, as GSAM points out, the returns from such an approach wind up being below a buy-and-hold approach.

The chart below illustrates the returns of this valuation approach compared to buying and holding the S&P. I.E. You sell stocks when valuations hit the 90th percentile and then buy back in when valuations are lower (at the 70th, 60th, and 50th percentile).

This analysis covers the period from January 1954 to September 2017 (the earliest and latest points the data was available respectively) and shows that playing this particular valuation game underperformed by 0.8% per year if one bought back when valuations fell to the 70th percentile, 0.9% at the 60th percentile, and a full 1.0% per year at the 50th percentile.

Now, if you'd really like to have some fun, compound 1% underperformance over 20 years and see what happens.

The takeaway here should be obvious. Using valuation levels as timing indicators to get in and out of the stock market is a losing proposition.

The key is that valuations can remain elevated for long periods of time and the market can move higher - sometimes significantly higher - during the time when the indices are considered very overvalued.

It is for this reason that the cliché I mentioned at the beginning exists. So, everyone, please repeat after me. "Valuations don't matter... UNTIL they do, and THEN they matter a lot!"

So, in my humble opinion, an elevated valuation condition is not, in and of itself, a reason to sell stocks. Instead, I believe high valuations should be viewed as a warning sign that investors need to be on the lookout for a bearish catalyst - which would indicate "when" valuations might begin to matter. Something like a recession, for example, could easily cause valuations to "matter." Until then, stocks can, and probably will march higher, infuriating the uneducated bears in the process!

Publishing Note: I am traveling the rest of the week and will publish reports as my schedule permits.

Thought For The Day:

Do not speak unless you can improve the silence. -Spanish Proverb

Current Market Drivers

We strive to identify the driving forces behind the market action on a daily basis. The thinking is that if we can understand why stocks are doing what they are doing on a short-term basis; we are not likely to be surprised/blind-sided by a big move. Listed below are what we believe to be the driving forces of the current market (Listed in order of importance).

1. The State of the Earnings Season

2. The State of Tax Reform

3. The State of the Economy

4. The State of Fed Policy

Wishing you green screens and all the best for a great day,

David D. Moenning

Chief Investment Officer

Sowell Management Services

Disclosure: At the time of publication, Mr. Moenning and/or Sowell Management Services held long positions in the following securities mentioned: none. Note that positions may change at any time.

Disclosures

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report is for informational purposes only. No part of the material presented in this report is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any investment program.

Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided.

The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

David D. Moenning is an investment adviser representative of Sowell Management Services, a registered investment advisor. For a complete description of investment risks, fees and services, review the firm brochure (ADV Part 2) which is available by contacting Sowell. Sowell is not registered as a broker-dealer.

Employees and affiliates of Sowell may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Positions may change at any time.

Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results.

Advisory services are offered through Sowell Management Services.

Recent free content from FrontRange Trading Co.

-

Is The Bull Argument Too Easy These Days?

— 8/31/20

Is The Bull Argument Too Easy These Days?

— 8/31/20

-

What Do The Cycles Say About 2020?

— 1/21/20

What Do The Cycles Say About 2020?

— 1/21/20

-

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

Modeling 2020 Expectations (Just For Fun)

— 1/13/20

-

Tips From Real-World Wendy Rhoades

— 5/06/19

Tips From Real-World Wendy Rhoades

— 5/06/19

-

The Best Recession Ever!

— 4/29/19

The Best Recession Ever!

— 4/29/19

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member