Markets climbed higher yet again last week, with both SPX and the Dow making new all-time highs. Last weekend, in my Market Forecast, I wrote:

"For the new week, it does seem like buyers are still trickling in. But, there's definitely caution on the market, as stocks have risen quite far in a month."

The broader market was stuck in a tight trading range, but, glided higher nevertheless. We had a mixed week. Here are the closed trades for the week:

| PCYC Options Sell to close 10.00 (3.77%) of PCYC Dec 20 2014 Call 150.0 at 4.50000 | 36.36% ($1,200.00) Profit |

| CLF Options Sell to close 10.00 (0.93%) of CLF Dec 20 2014 Call 11.0 at 1.07000 | -21.32% ($-290.00) Loss |

| DE Options Sell to close 15.00 (2.12%) of DE Nov 22 2014 Call 87.5 at 1.64000 | 64.00% ($960.00) Profit |

For the week, the Dow was up +60.81 points; SPX added +7.9 points; Nasdaq gained +56.01 points. Oil continued to sinking, trading down to $75-and-change/barrel. Gold had a big bounce trading above $1186/ounce. At the time of this writing, Asian markets were mostly lower, on the news that Japan had slipped into recession in the third quarter. Here's where the US markets closed on Friday:

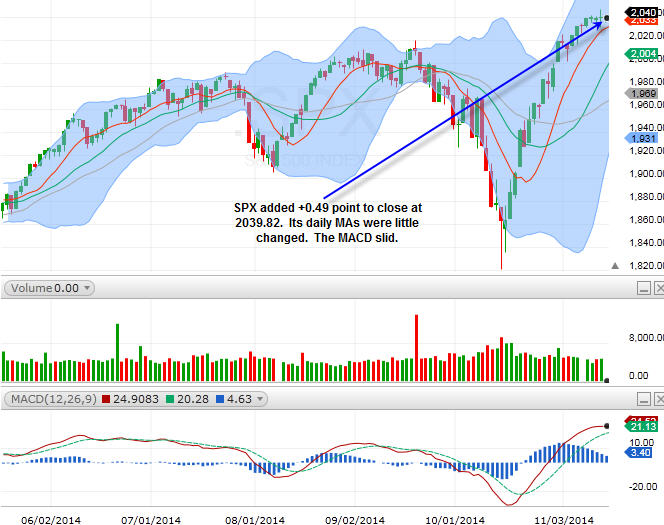

SPX

On Friday, SPX added +0.49 point to close at 2039.82. Its daily MAs were little changed The MACD slid.

Nasdaq

Nasdaq gained +8.4 points to close at 4688.54. Its daily MAs and MACD were little changed.

Both SPX and Nasdaq held up above their respective daily MAs. But, SPX looks tired. For the new week, I think the market is ready for a little pullback, at least to start the week. However, I think it will still be a mixed market. There are still buyers looking to get in. For SPX, we should see some support near 2020. For Nasdaq, the support is between 4610 and 4600. Financials seems overdue for a pullback. However, internet stocks still look strong with room to go higher. Energies will be very important. Gold could be on a strong bounce. Fed minutes are due on Wednesday and the latest housing data will also be reported.

Sector Watch

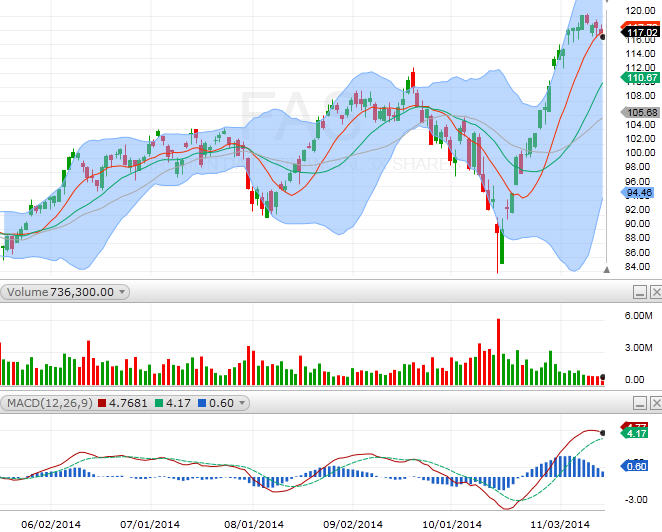

FAS (financial)

FAS closed below its 10-day MA. GS, BAC, WFC, and JPM are already looking vulnerable. MA has pulled back as well. I may have been early on V puts, and will be looking again in the new week.

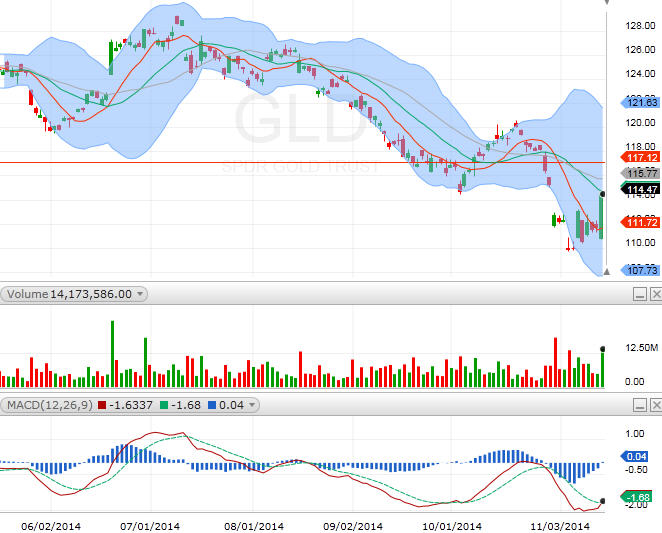

GLD (gold)

GLD rose sharply on Friday, touching its 20-day MA. With G20 vouching to create more stimuli to boost the global economic growth, gold may continue to bounce next week.

XRT (retail)

XRT still looks strong. With the holiday season coming up, this sector will be very important. The recent earnings from this group suggest that things should be pretty solid for the holiday shopping. TGT, BBY, and GPS are all reporting next week.

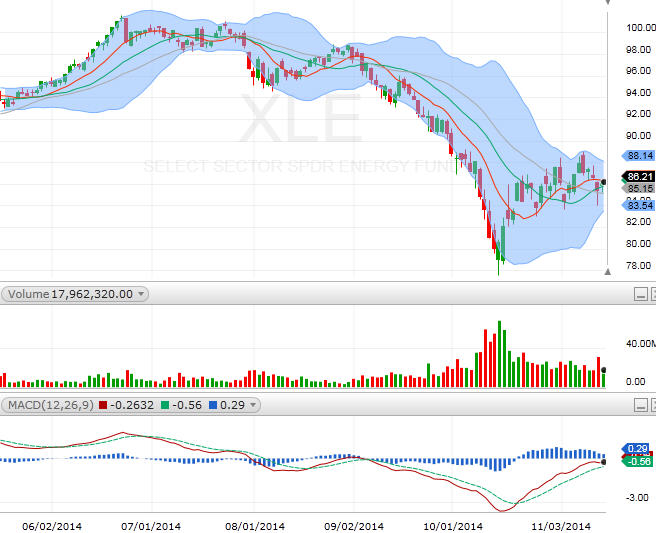

XLE (energy)

XLE is desperately trying to draw a bottom. The potential HAL/BHI deal temporarily stopped the bleeding last week. XLE closed right at its 10-day MA. If it rises above, XLE will turn bullish. I will be watching EOG, APC, APA, NOV, MPC, and OXY.

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Stocks Ready For A Bounce

— 7/07/22

Stocks Ready For A Bounce

— 7/07/22

-

Two Quick Trades: FB, GME

— 5/12/22

Two Quick Trades: FB, GME

— 5/12/22

-

Dow Stocks Are Falling, and 3 Dow Stocks to Sell

— 5/12/22

Dow Stocks Are Falling, and 3 Dow Stocks to Sell

— 5/12/22

-

(Much) More Downside to Come?

— 5/11/22

(Much) More Downside to Come?

— 5/11/22

-

Is Gold A Safe Haven Again? GLD

— 2/09/16

Is Gold A Safe Haven Again? GLD

— 2/09/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member