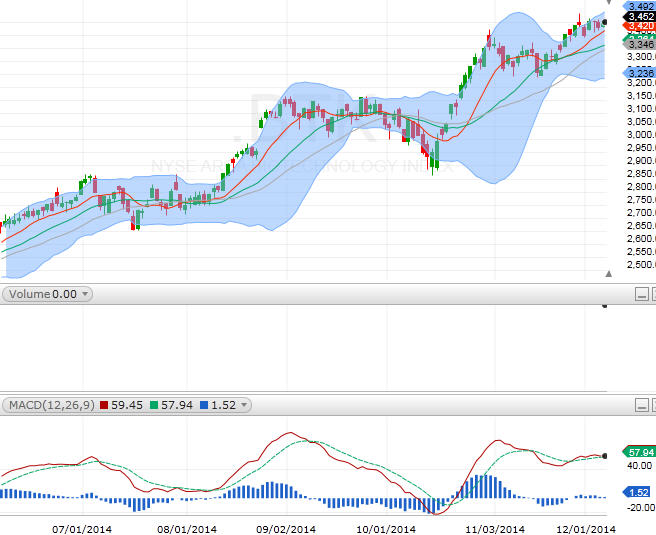

Both SPX and the Dow made new all-time highs again last week! Financials were very strong, which over-compensated for the weakness in energies.

Stocks took a quick fall on Monday, and SPX tested 2050. But, buyers quickly came in and drove things back up on Tuesday and Wednesday. Thursday saw a little stutter before the latest jobs report. Financials led the markets higher on Friday, as investors cheered the strong jobs data.

For the week, the Dow was up +130.55 points; SPX added +7.81 points; Nasdaq fell 10.87 points. Gold dropped to $1190/ounce and oil tumbled down to below $66/barrel. At the time of this writing, Asian markets were up. Here's where the US markets stood after Friday's close:

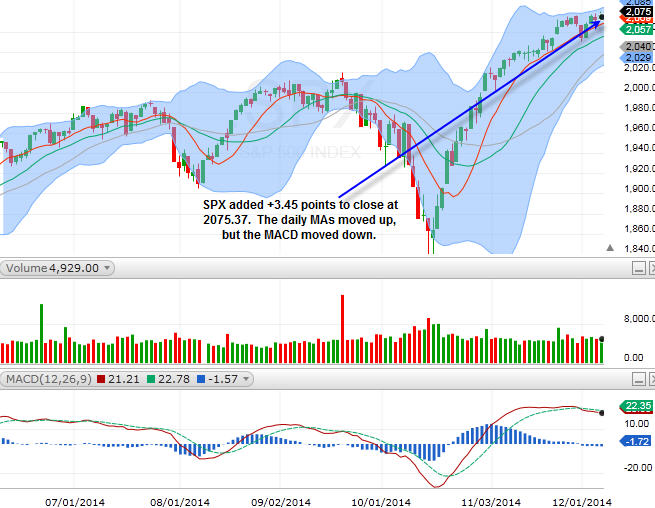

SPX

On Friday, SPX added +3.45 points to close at 2075.37. The daily MAs moved up, but, the MACD moved down.

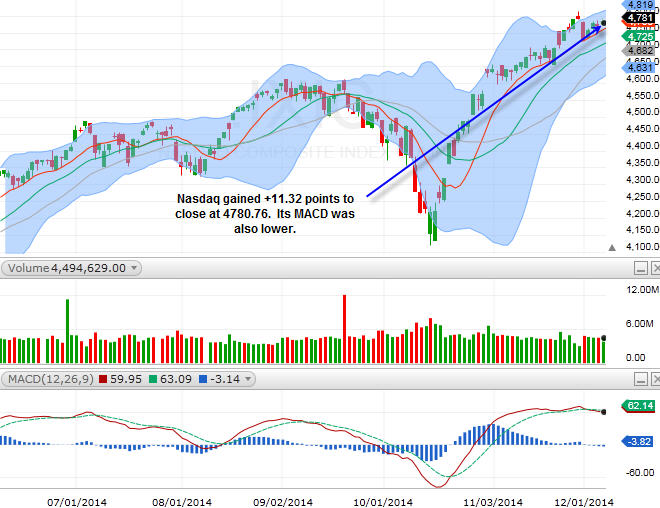

Nasdaq

Nasdaq gained +11.32 points to close at 4780.76. Its MACD was also lower.

Although both SPX and the Dow made new all-time highs, the MACDs are still weak, something to be cautious about. Nasdaq actually ended slightly down last week. For the new week, however, it does seem that the Dow wants to push higher. SPX came close to 1980 on Friday. We will see if it can break above it in the coming week. Financials really pushed the broader market up last week. Most other sectors were not nearly as strong. Oil is still falling and energies are going along with it. Surprisingly, the retail sector pulled back as well.

Sector Watch

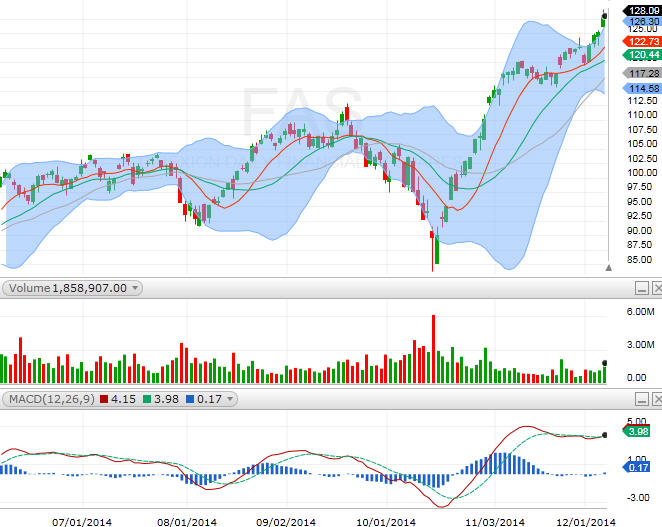

FAS (financial)

FAS got a big pop on Friday after the latest jobs report. GS, WFC, BAC, JPM all broke out. V and M continued to make new highs as well. We should look at STI and PNC as well. It's hard to say if the buying will follow through on Monday as Friday's pop was quite substantial.

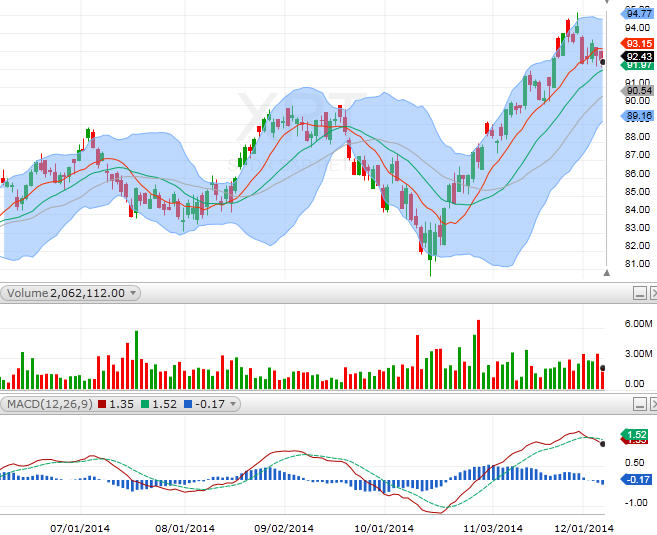

XRT (retail)

XRT fell last week, and the MACD went bearish! WMT, BBY, and AMZN all pulled back. We were looking to trade on the long side on these. But, as I cautioned in last week's Market Forecast, we waited to see how Monday would trade. It turned out that Monday did indeed get a pullback. Retails underperformed all weak, as the Thanksgiving shopping was not as busy as expected. KORS, however, bucked the trend, and I like how it is looking. Let's keep an eye on LULU as well.

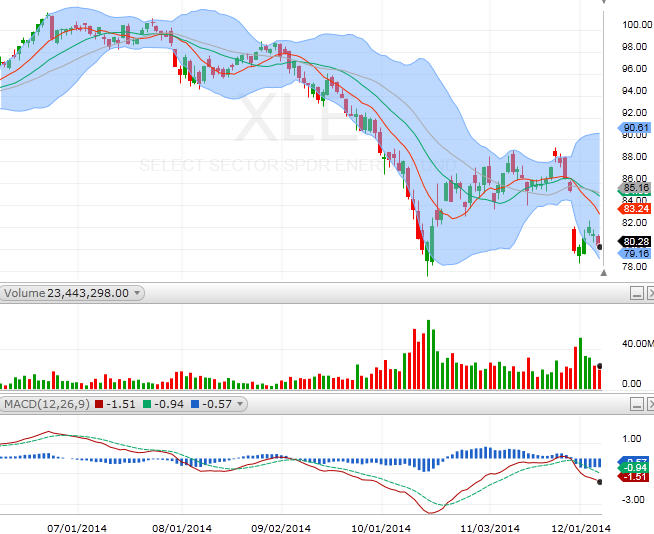

XLE (energy)

XLE did manage to eke out a gain for the week. But, Friday's weakness didn't help. Most energy stocks showed similar development. Riggers are especially weak (RIG, DO). OXY and FLR look ok. SLB held up on Friday, as well.

BTK (biotech)

BTK is still hanging on. BIIB got a strong pop this week and that helped the sector. JAZZ is trying very hard to break out. Let's watch AMGN on Monday, as the company released favorable data on its myeloma treatment this weekend. I also think CLVS and GILD may be staging a bounce.

Although the broader markets are creeping higher, the overall environment is still very secular. Some sectors are actually moving lower. So, I'm still cautious. We have to be very selective in our trades.

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Stocks Ready For A Bounce

— 7/07/22

Stocks Ready For A Bounce

— 7/07/22

-

Two Quick Trades: FB, GME

— 5/12/22

Two Quick Trades: FB, GME

— 5/12/22

-

Dow Stocks Are Falling, and 3 Dow Stocks to Sell

— 5/12/22

Dow Stocks Are Falling, and 3 Dow Stocks to Sell

— 5/12/22

-

(Much) More Downside to Come?

— 5/11/22

(Much) More Downside to Come?

— 5/11/22

-

Is Gold A Safe Haven Again? GLD

— 2/09/16

Is Gold A Safe Haven Again? GLD

— 2/09/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member