De Facto Insider James Farinella of Integrated Capital Partners Appears to Secretly Pump Pazoo While Dumping Shares

There are now over 300 cannabis-related stocks in the universe that 420 Investor tracks. Most of these companies are not anything more than opportunists, though there are several real companies. Pazoo (PZOO) is a penny stock that jumped in to the frenzy at the top, announcing in early 2014 that it was extending from the human and animal health and wellness business into the burgeoning cannabis testing lab business. Ordinarily, this type of business move should be viewed cynically, but in the case of PZOO, it inked a deal with an entity, MA Associates, with a license with highly respected Steep Hill Labs to open a testing lab in Las Vegas using its name and operating procedures. PZOO now owns 100% of MA Associates, which won a license from the state in November.

When I launched coverage of PZOO on June 1st, including it in my Focus List, I suggested that it is among the most promotional stocks in the space. StockPromoters.com indicates that the company has had 560 promotions since going public three years ago, but, to be fair, some of these are traditional I.R. activities. Many, though, are of a more vile nature, like a third-party entity, OT Group, LLC, spending $175K over July 9-10, a time during which the company also engaged Small Cap Voice and Bull In Advantage to help spread the word while it released three separate press releases within 24 hours as the CEO conducted interviews with Money TV and Green Baron as well.

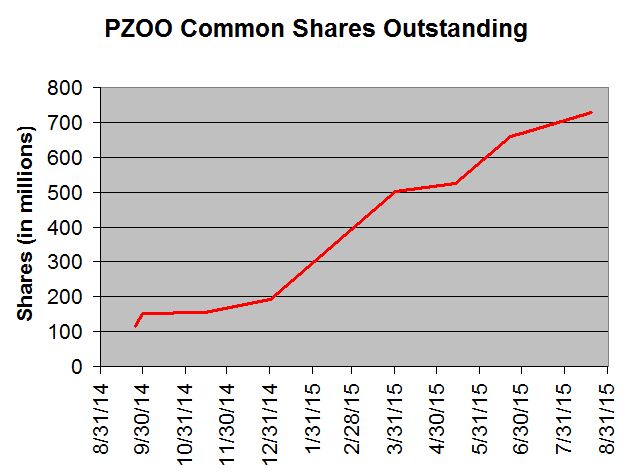

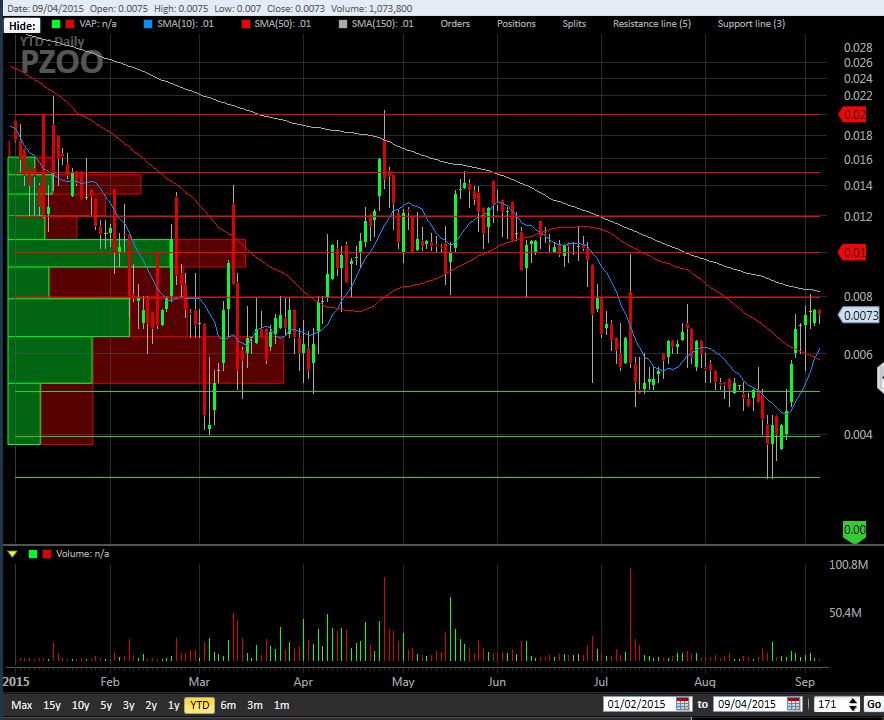

As I have mentioned, Pazoo faces a serious cash crunch. The company has invested in the buildout of its Nevada lab, but it still isn't open. In fact, according to the CEO as conveyed in the recent conference call, the company still doesn't have a certificate of occupancy three months after its "Grand Opening Party." The debt obligations and lack of revenue are likely driving the promotional activity. Quite simply, if the company is unable to raise sufficient cash over the next few months, it will endure another round of dilution as maturing debt is paid with shares. For those who haven't been watching the explosion in shares, this chart shows the growth over the past year:

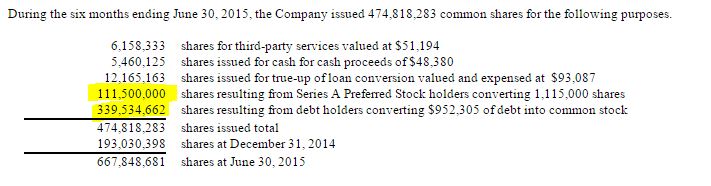

The last reported share-count stands at 728mm as of mid-August, up from 114mm last September, but the SEC filings clearly indicate that it is likely headed much higher. There are several drivers of the higher share-count, including conversions of convertible debt and convertible preferred stock (Series A). The most recent 10-Q details just the change from year-end through 6/30 (an increase from 193mm to 668mm) very clearly:

Since quarter-end, convertible note exercises have added 36.21mm shares, while preferred equity conversions have added 20mm (as described in the most recent 10-Q). The outlook is that the share-count will continue to rise. The easiest sources of future dilution to assess are the Preferred shares. The company has two classes that convert, the Preferred Series A and the Preferred Series C. Each converts to 100 common shares. As of 6/30, there were 2.463526mm Series A and 1.08mm Series C. These can't all immediately convert but will eventually add hundreds of millions of shares. Additionally, the company has issued warrants on the Preferred Series A. At 6/30, there were 2.325mm with an exercise price of $0.50, which could effectively result in the company selling 232.5mm shares at $0.0050. The warrants expire in 2020.

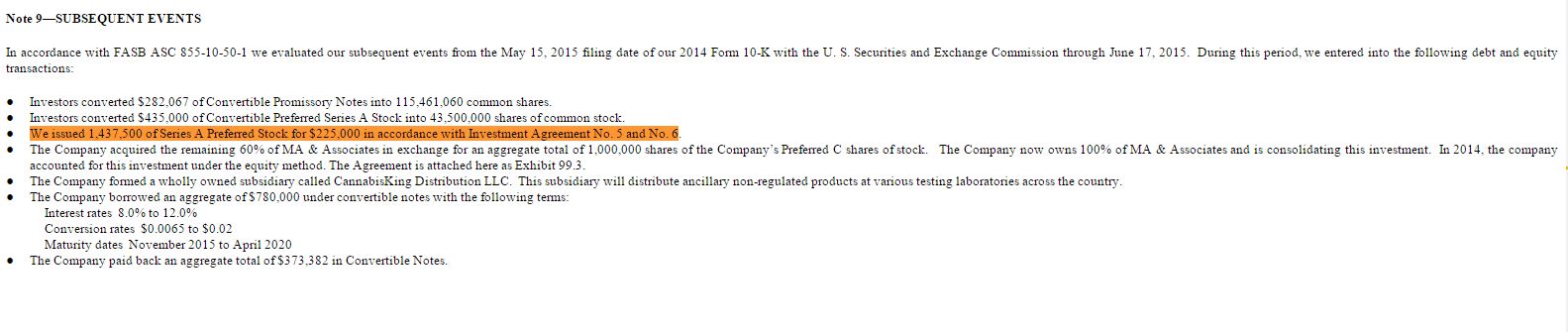

More difficult to assess are the convertible notes, as the company fails to provide enough detail in its filings. In the 10-K annual report, it lists in detail all of the debt issued in 2014, but its 2015 quarterly filings provide only an overview, making it difficult to project future conversion dates or the amount of shares that could be created. It is clear that much of the debt is "toxic", meaning that the lower the price, the more shares borrowers receive upon conversion. Note 6 of the 6/30 10-Q has a table that shows the gross amount of convertible debt due within 12 months has grown from $1.313mm at year-end to $1.321mm as of 6/30. This is up from $829K as of 3/31. The filings indicate the conversions very clearly, but they don't give investors the complete picture on new debt. In the subsequent events section of the Q1 10-Q, the company shares the following regarding debt issued after 5/15 (possibly an error, as it should be from 3/31) but before 6/17 :

The Company borrowed an aggregate of $780,000 under convertible notes with the following terms:

Interest rates 8.0% to 12.0%

Conversion rates $0.0065 to $0.02

Maturity dates November 2015 to April 2020

This doesn't give the complete picture at all, as investors should understand the true conversion features (i.e. the discount to some specified calculated price rather than the maximum fixed-price and the exact dates for each borrowing). In Q2, they did a better job, listing this issuance following 6/30:

The Company borrowed one Convertible Note of $125,000 under convertible notes with the following terms: 8.0% interest, maturity date of 4/14/16, and a conversion price calculated at 50% discount to the lowest trading price of the previous 15 days.

So, without a full table of debt and terms, it's impossible to know exactly how quickly or by how much the share-count will increase. PZOO has engaged in a risky strategy of having multiple lenders, as this creates an environment for aggressive liquidation of converted shares, as we saw earlier this year when a round of conversions pushed the price to what was then an all-time low of $0.0040. With the new debt issued after 6/30, the company is on the hook for lots of cash (or conversions).

At 6/30, the company reported cash of just $153K. Through the first six months of the year, it used $1.067mm cash to fund its operations. It reported in its subsequent events that it raised $125K with new convertible debt issuance, but it also indicated that is has an agreement to lend up to $2.5mm to Harris Lee Colorado (where will it get this money???). In the last quarter, its legacy business generated lemonade-stand revenue essentially, with sales of just $1399. None of its labs are open yet, as Nevada isn't yet operating, Oregon isn't yet constructed and Colorado hasn't yet closed (it is awaiting license transfer from the MED). Its new distribution business is just getting started. It is highly unlikely that the company will generate positive cash flow. In fact, a reasonable guess is that there will be a continued large cash burn, which will lead to further dilution.

I would like to point to a materially false statement in the recent conference call, as it conflicts with the SEC filings, which suggest that 340mm shares have been issued for debt conversions in 2015. This is CEO Cunic answering the first question:

The next part of this first question was about stock dilution. I want to go over some facts about that because I have done emails, phone calls from people saying, oh well there has been 200, 300, 400 million of shares of dilution last few months, when that’s not the reality at all. If you were to look at our queue and you look at our convertible notes over the past three months you will see the breakdown of the convertible notes. In the month of May there were 17 million shares of convertible notes. In the month of June there was less than 10 million shares of convertible notes and in July there was about 12 million shares of convertible notes. If you look over the past 400 days or so there has been less than 40 million shares of dilution, alright. Once again I do not know where people are getting these numbers of 200 to 300 and 400 million shares of dilution over the last three months because it's just not there, it's only been around 40 million shares.

I call b.s.! Again, from the company's own SEC filings - page 7 of the 10-Q from Q2 issued on 8/19:

339,534,662 shares resulting from debt holders converting $952,305 of debt into common stock.

That was for all of 2015, and the company indicated that in Q1

231,583,201 shares resulting from debt holders converting $679,251 of debt into common stock

So, over 100mm April through June, and over 36mm between 6/30 and 8/19 as stated by the company in the subsequent events section of the most recent 10-Q. CUNIC IS EITHER NOT TELLING THE TRUTH OR IS IMPROPERLY INFORMED.

I want to drill down on the Preferred A, as this class of stock has been around since the company went public in 2012. The new Preferred C is locked up and has been issued to pay for the acquisition of MA Associates and Harris Lee. According to the 10-K form 2014, there were approximately 923K outstanding at the end of 2013 and 1.036mm at the end of 2014. Note that the company reverse-split this class 10:1 in 2014 as it was approaching the A/S of 10mm. The most recent filing indicates, as described above, over 2.46mm at 6/30 (with 2.325mm warrants as well). The table above also indicates that 1.115mm were converted so far in 2015, resulting in the issuance of 111.5mm shares of common stock. Note that this exceeds the amount in existence as of 12/31/14: Some of the conversions were from preferred stock issued in 2015.

In 2015, almost all of the Preferred A shares issued have been issued to "ICPI", which I will discuss below. ICPI, which is entitled to one warrant at $0.50 per preferred share it purchases, has received 2.325mm, which is 50K short of the total listed as issued in the Q2 10-Q of 2.375mm. Again, each share converts to 100 common shares. The 10-K for 2014 stated in the subsequent events that 50K Preferred A shares were issued to private investor Rick Marion at $1.00 per share ($50K). The balance were issued at $0.20-.40. From the 10-K subsequent events:

- In January 2015, we sold 75,000 Preferred A shares at $0.40 per share for $30,000.

- In February 2015, we sold 25,000 Preferred A shares at $0.40 per share for $10,000.

- In February 2015, we sold 300,000 Preferred A shares at $0.20 per share for $60,000.

- In March 2015, we sold 375,000 Preferred A shares at $0.20 per share for $75,000.

The total disclosed was 775K shares for a total of $175K (excluding Marion's 50K for $50K). The 10-Q for Q1 updated the total to "875K shared for $235K cash", which suggested another 50K shares for Q1 issued for $10K to ICPI ($0.20 per preferred share).

When the company filed its 10-Q for Q1 in mid-June, it apparently made an error that became evident in August, when it filed the 10-Q for Q2. It had previously listed on page 10 as a subsequent event:

We issued 1,437,500 of Series A Preferred Stock for $225,000 in accordance with Investment Agreement No. 5 and No. 6.

This works out to less than $0.0016 per common share on a converted basis, but it turns out that this was apparently incorrect. The 10-Q from Q2 clarified the issuance, which has been no lower than $0.20 per preferred share, as the company updated the YTD total to "2.375mm shares for $580K cash", which suggested that Q2 issuance was 1.5mm preferred shares for $345K ($0.23 per share). For the year, then, the total issuance was at an average price of $0.2442. The ICPI issuance of 2.325mm shares (98% of the shares issued) for $530K works out to $0.228 per share, giving it the right to convert to 232.5mm shares at $0.00228 per share (with warrants to buy a similar amount at $0.005 per year.

So far, we have established that ICPI has both bought a bunch of Preferred A shares as well as converted some into over 100mm common shares, and this is where the story gets very interesting. No one but ICPI knows at what prices its shares were sold or how many it actually sold, but we can figure out that a handy profit was made on the liquidation relative to the cost of the new shares, as the lowest price in Q1 was $0.0040 for Pazoo, with a high of $.0219. From the filings, we know that 60mm shares were issued to ICPI in Q1, and 51.5mm in Q2, when the price range was $0.0049-.0204.

U.S. securities laws require holders of 5% or more to file a 13-D. The SEC states:

Schedule 13D is commonly referred to as a “beneficial ownership report.” The term "beneficial owner" is defined under SEC rules. It includes any person who directly or indirectly shares voting power or investment power (the power to sell the security).

When a person or group of persons acquires beneficial ownership of more than 5% of a voting class of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934, they are required to file a Schedule 13D with the SEC. (Depending upon the facts and circumstances, the person or group of persons may be eligible to file the more abbreviated Schedule 13G in lieu of Schedule 13D.)

ICPI has never filed a 13D for PZOO. In fact, its investment agreement with the company PROHIBITS it from having more than 4.99%:

The Investor hereby agrees that at no time shall it convert Series A Convertible Preferred Stock of the Company if, following such conversion, the Investor would hold more than four and ninety-nine one hundredths of one percent (4.99%) of the common stock of the Company then issued and outstanding. In the event the Investor submits a Notice of Conversion which would be contrary to this provision, the Company may modify the Notice of Conversion to give effect for this provision and return any Series A Preferred Stock not converted to the Investor.

Taking the current outstanding shares as of 6/30 of 668mm, the maximum number of shares held by ICPI (4.99%) would be 333mm. Thus, ICPI has sold at least 78.2mm shares through 6/30. Taking into account the additional 20mm shares issued after 6/30, which brings the YTD total to 131.5mm shares converted and using the 728mm shares outstanding as of the 8/19, ICPI can hold no more than 36.3mm. Thus, ICPI has sold at least 95.2mm shares in 2015 through mid-August.

Now, let's talk about ICPI, which stands for Integrated Capital Partners, Inc. The company lists a Mail Boxes Etc. in New Jersey as its headquarters, not far from the corporate headquarters of PZOO. It's principal is James M. Farinella, who has been involved with David M. Cunic since before PZOO went public in 2012. Both men appear to reside near the PZOO headquarters as well.

Farinella is somewhat of an internet ghost. His LinkedIn profile shares only his education and current position as President of ICPI. The website of ICPI forwards to www.StockReportCard.com:

My intent is not to provide a full diligence of Mr. Farinella, who has been involved with penny stocks for more than a decade, but to focus on his recent unethical behavior, at least in my view. I want to stress that I don't think he is doing anything illegal.

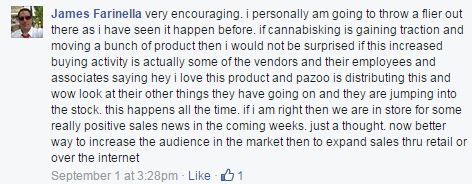

I have been aware of his participation in a Facebook group called "PZOO/Steep Hill Labs Investor Group" . Farinella posts very positive messages there, pumping the stock. Here is a great example:

Pazoo, Inc. Subsidiary CannabisKing Distribution Adds Over 10 New Accounts; Company Receives Steady Reorders and Additional Commitments for AccuVape

Probably just a coincidence! It's not like Farinella actually has close contact with the company. Whoops, apparently he does!

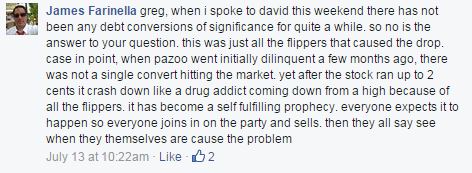

The CEO discussed debt conversions with Farinella? That is material information being disclosed privately. Wow! By the way, again, per the Q2 10-Q, there were 36mm shares converted between 6/30 and 8/19.

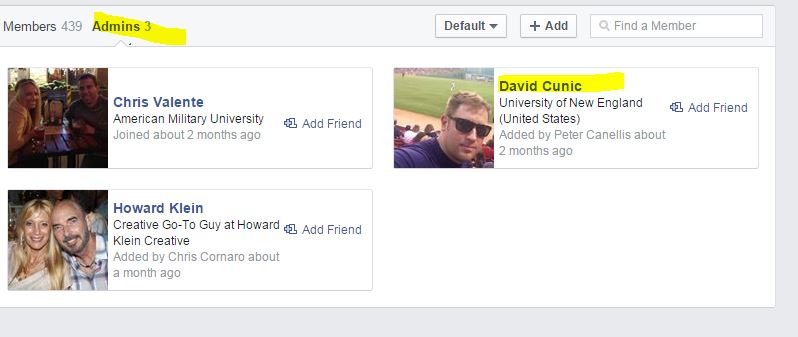

While some may be familiar with his role as a primary financier of the company, this would not be obvious to all. This site was set up by "GreenHouse Investment Group" earlier this year, but the company recently terminated the relationship and took over the site. In fact, CEO David Cunic is an administrator!

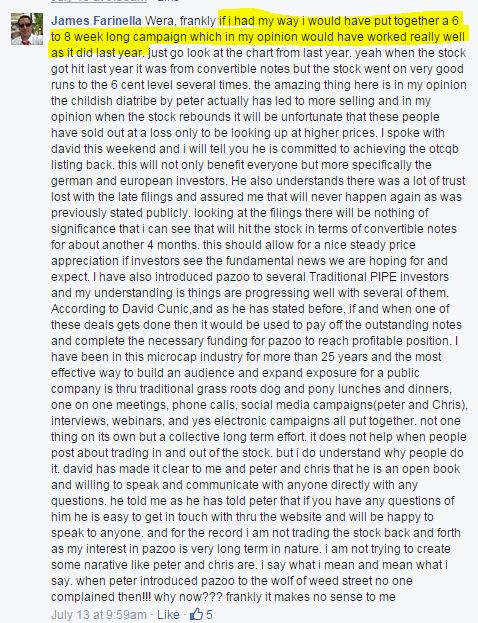

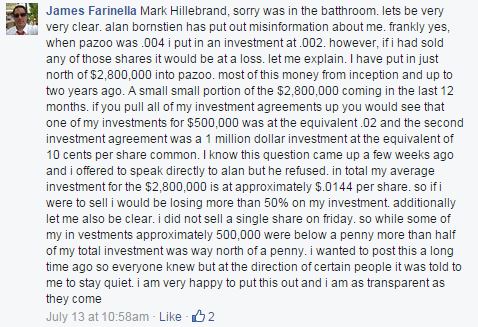

In mid-July, there was an uproar over the promotion blitz discussed above, and Farinella shared his views:

Farinella has a long history of pumping. He was CEO of penny stock

SoftNet Technology, formerly T&G 2, and his tactics earned an article back in 2003 in Kiplinger's, "Pitching Pennies." Like PZOO, that company was upside down in its finances and also traded in Germany, which may facilitate dumping. SoftNet Technology didn't end well despite the promising outlook Farinella shared in late 2004:

"The development of Wholesalebyus has been tremendous," said Mr. James M. Farinella, CEO/President of SoftNet Technology. "However, I am just so excited by what is transpiring with the SecureTime Biometric System. The sales for the SecureTime System should really begin to accelerate in the coming year."

Farinella checked out in September 2006 after converting preferred shares to common shares just weeks earlier. This is what happened on his watch:

We have already established not only that Farinella has been a seller of PZOO but that he has a history of pumping and apparently thinks it's a good thing too. Investors seem to be picking up on what's likely going on: Farinella and/or the company go on aggressive promotional campaigns that result in heavy selling. The company is desperately seeking funding to avoid convertible note conversions and is suggesting that it will pay them in cash. From the recent conference call:

In terms of the question about, any possible dilution for the balance of the rest of the year? Yes, there are convertible notes that are coming due sometime in the fourth quarter. But which was brought up before, the Small Cap Voice, Money TV as well as post on the Facebook pace was how some of these convertible notes that we took -- actually the majority of that we took, we've actually already prepaid them before in the past. Oaky, our goals and our attention is to prepay these notes off as well also. Some of the larger private direct investments that we're talking to these people actually would like to take out these convertible notes.

With no cash flow from operations, it will require the issuance of more securities. The company is talking to people about "larger private direct investments", but the clock is ticking. If it doesn't succeed, there will be another wave of dilution.

Farinella likes to say how much he has invested in the company (but never talks about his sales):

Pazoo, Inc. Confirms Paying Off Note to Eastmore Capital LLC, More Than a Week Early and Plans to Retire the Few Notes Remaining Through the Summer

Well, we know that didn't happen! The summer isn't over, but the company has many convertible notes outstanding and has issued more new debt this summer.

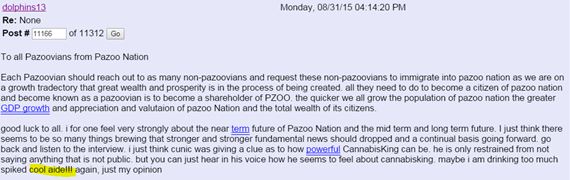

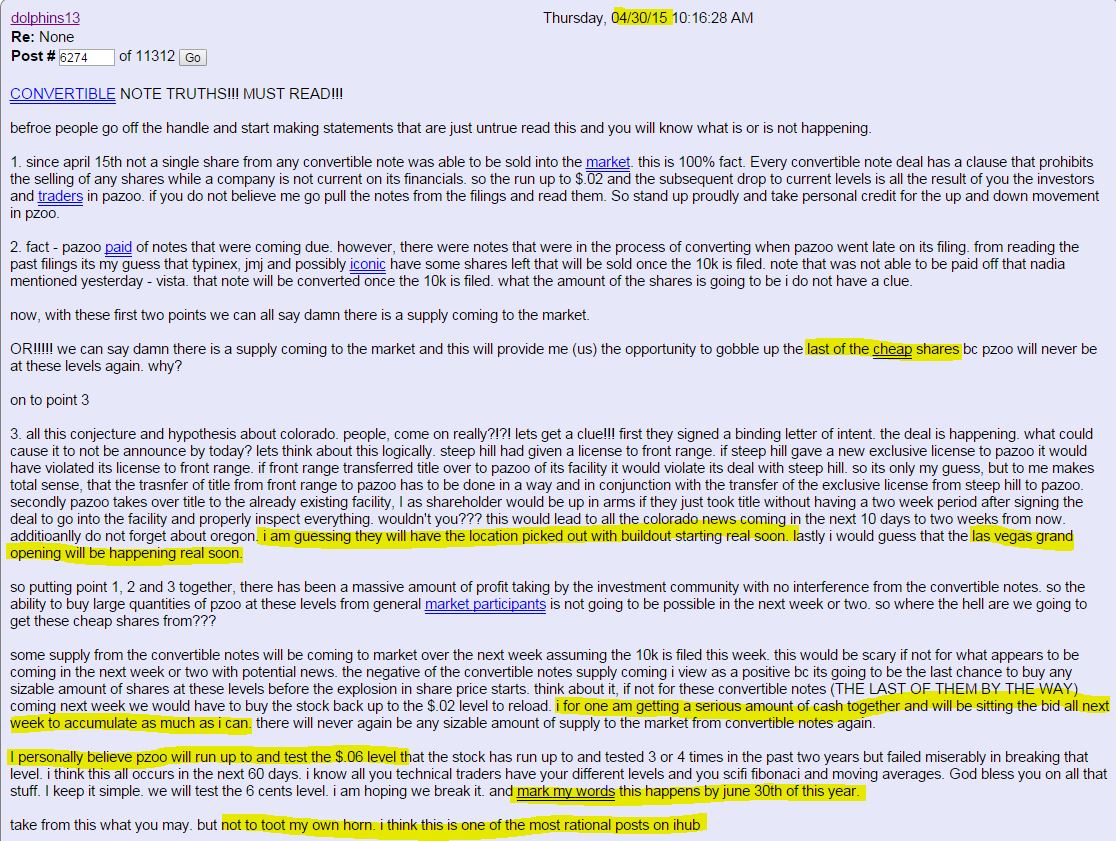

After the stock reversed off the .02 level, "dolphins13" weighed in, defending the stock:

Wow! I highlighted some things that I find really disturbing! The most alarmingly false statement is that he discussed BUYING shares of the common when it is clear he was likely SELLING! The only way Farinella didn't sell (assuming this is Farinella) is if he failed to file a 13D with the SEC.

PZOO is a penny stock from day one, full of typical penny stock issues. Despite the obvious tendency towards excessive promotion, I had thought that the Steep Hill relationship made this one that could succeed despite these challenges. Having watched the stock closely now for more than six months, I am now convinced that if the company is ever to succeed, its investors will likely struggle to participate. I have shown the massive dilution already and suggest that more is likely ahead. Perhaps the company will pull the proverbial rabbit out of a hat and find some way to pay off the converts, but this appears to be a long-shot. With de facto insider and perennial penny stock guy Farinella engaged in questionable activities designed to promote his own interests, I believe investors should be cautious with PZOO.

SEC filings cited:

Addendum (9/8/15)

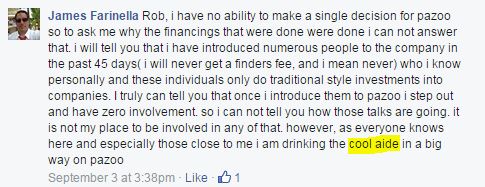

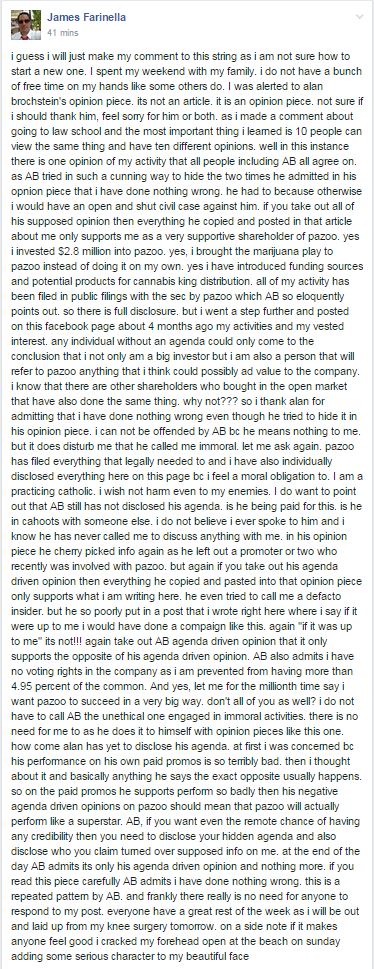

I forwarded this article to David Cunic and gave him an opportunity to correct any errors. I also offered to print in full any response. Today, James Farinella posted this to the PZOO Facebook page:

https://www.facebook.com/groups/Pzoo.SteepHillInve...

- My agenda is only getting to the truth of the matter. I have never received compensation from any public company or from a third-party with respect to any of my professional activities

- Farinella didn't address either of the key issues raised

- Is he "dolphins13" on I-Hub?

- Has he sold 95mm shares while pumping the stock?

Recent free content from Cannabis Analyst

-

Marketfy Has Evolved - We're Moving to a New Platform!

— 3/06/24

Marketfy Has Evolved - We're Moving to a New Platform!

— 3/06/24

-

420 Investor Weekly Review 12/23/22

— 12/26/22

420 Investor Weekly Review 12/23/22

— 12/26/22

-

420 Investor Weekly Review 12/16/22

— 12/16/22

420 Investor Weekly Review 12/16/22

— 12/16/22

-

420 Investor Weekly Review 12/09/22

— 12/09/22

420 Investor Weekly Review 12/09/22

— 12/09/22

-

420 Investor Weekly Review 12/02/22

— 12/02/22

420 Investor Weekly Review 12/02/22

— 12/02/22