The large-cap S&P 500 index has been in free-fall mode for 7 sessions now. This selloff is largely due to the pricing crunch in oil and the energy complex, but also in anticipation of the Fed's rate hike cycle, the rise of geopolitical tension (i.e. Russia), and an economic squeeze in emerging markets. The index has been propped up in recent weeks for its exclusive status as the world's only "safe" haven for investment capital. But even that is no match for these economic realities.

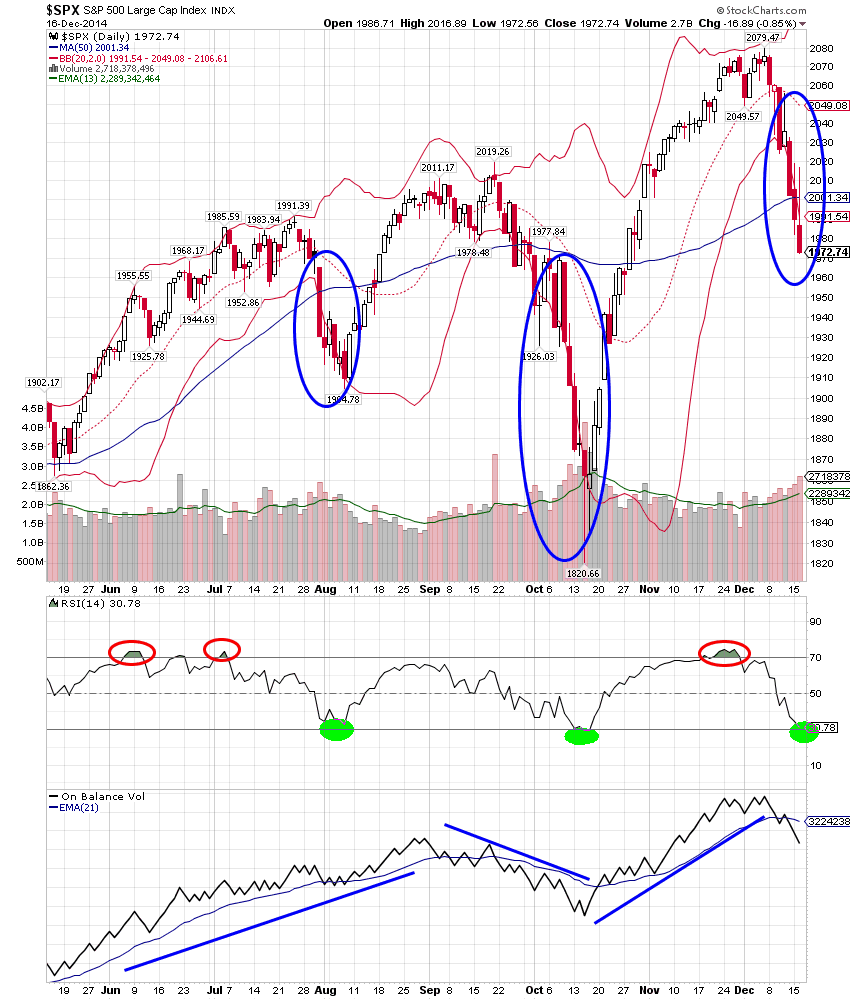

The chart below shows that while we will likely see more downside pressure on the Index before the current slide establishes a bottom, we are seeing a potential multi-week buy signal forming. The Relative Strength Index is slipping into oversold territory (< 30), and this volatility is causing the standard deviation bands to stretch to an unsustainable width.

Today's FOMC announcement will act as a short-term catalyst. There is certainly risk of a deeper discounting of the index if Yellen's language is more hawkish than expected. A more likely scenario is that all will go as expected and we will get a relief rally into the end of the week. Regardless, the "risk-off" trade will need a few sessions to work itself out of the order flow. Given that, and considering the seasonally influenced bullishness that should support the markets into the end of the year, the S&P 500 should yield a very profitable entry point within the next few trading sessions. Keep on alert!

Best ways to play this:

- buy the 2x Bull S&P 500 ETF (SS0)

- buy the March 20th SPY calls

- buy shares of the top 5 S&P stocks (AAPL, MSFT, XOM, JNJ, GE)

Recent free content from Dr. Thomas Carr

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member